What is the current 30-year fixed rate?

Mortgage rates at 5.99%

Updated October 29th, 2025

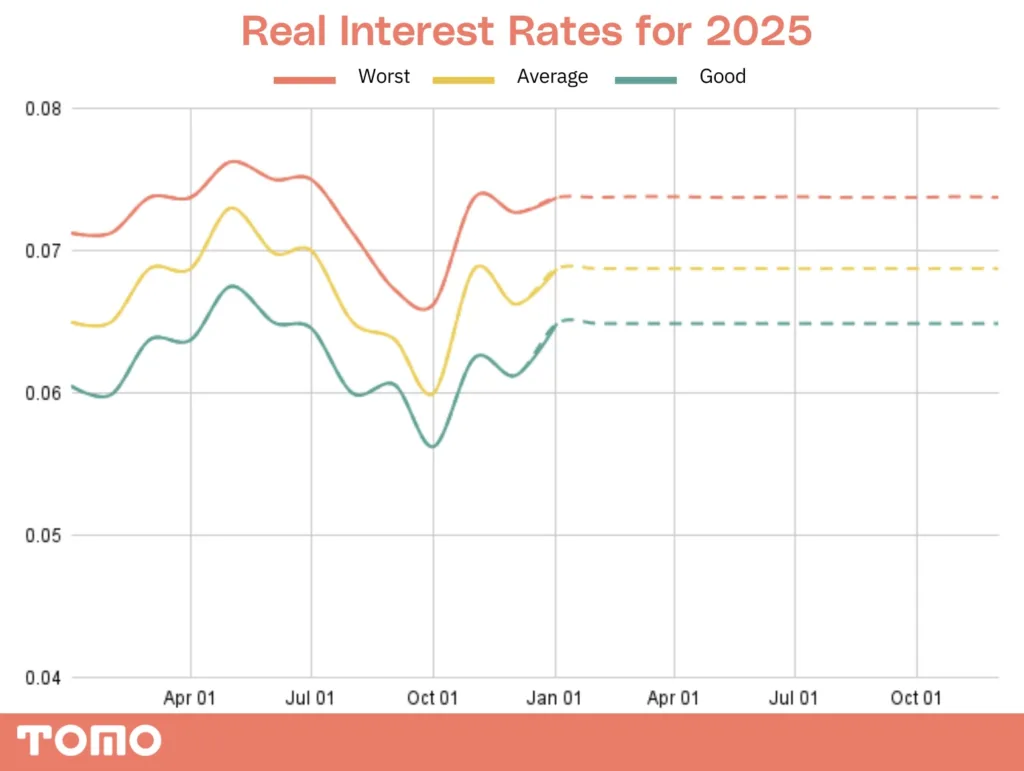

The chart above shows real interest rates locked for 30-year conventional loans for people with good credit by over 1,000 different lenders over the course of 2024, and the dotted line is our projected forecast for 2025.

The average rate, or 50th percentile, serves as a key marker for rate shoppers. It represents the point where half of borrowers locked in rates below and half locked in rates above, whereas the red worst line, shows the 95th percentile, or “rip off rates” that unfortunately some lenders will offer.

If this graph conveys one thing its that the most important thing homebuyers can do in 2025 to get a lower rate is to shop around between lenders.

2025 Outlook

What is Tomo’s mortgage rate forecast for the end of 2025?

| Quarter | Tomo prediction | Actual |

|---|---|---|

| Q1 2025 | 6.875% Est | |

| Q2 2025 | 6.875% Est | |

| Q3 2025 | 6.875% Est | |

| Q4 2025 | 6.875% Est |

Key factors driving rates in 2025:

- The labor market: the labor market will continue to drive inflation outcomes and influence Fed policy.

- Fiscal and regulatory policy: fiscal and regulatory actions will play a larger role in shaping mortgage rates than the Fed’s monetary policy.

What’s affecting interest rates right now?

Mortgage rates rose following the October Fed meeting, after having fallen slightly in the middle of the month, and ultimately wound up ending the month exactly where they started. While the Federal Reserve elected to cut the Fed Funds rate by 25 basis points (bps), as expected, commentary from Jerome Powell following the decision indicated that the Federal Reserve may be willing to keep rates steady in the December meeting, which drove yields on 10-year Treasury bonds higher.

Stepping back, economic conditions haven’t changed much since the last couple of Fed meetings: The Fed is still stuck between inflation that is higher than they would like and an unemployment rate that is higher than they would like. While comments from the Fed today indicated that the risk of higher inflation may warrant slightly more restrictive conditions, we will need to see a material shift in the underlying data for monetary policy to move in a way that will significantly shift mortgage rates.

Current mortgage rates

You can see personalized rates on our current mortgage rates page (we promise they are real rates for real people).

| Product | Rate-October. 29th | Rate-October. 3rd | Change |

|---|---|---|---|

| 30 Year Fixed | 5.99% | 5.99% | no change |

| 30 Year Fixed – VA | 5.875% | 5.875% | no change |

| 30 Year Fixed – FHA | 5.625% | 5.625% | no change |

| 30 Year 7/6 ARM | 6.375% | 6.375% | no change |

| 15 Year Fixed | 5.49% | 5.49% | no change |

2024 Lookback

| Quarter | Tomo prediction | Actual |

|---|---|---|

| Q1 2024 | 6.875% | 6.875% |

| Q2 2024 | 6.625% | 7.0% |

| Q3 2024 | 6.5% | 6.5% |

| Q4 2024 | 7.0% (revised from 6.375%) | 6.875% |

2024 marked the second consecutive year that began with market consensus forecasting a steep drop in interest rates as the year progressed. While I didn’t expect rates to fall into the 5s, I also anticipated a downward shift throughout the year. In August 2024, we experienced what I described as a “macroeconomic shift,” prompted by a notably weak Labor Market Report that seemed to provide the data the Fed needed for a true pivot. Unfortunately, that report turned out to be more of a blip than a lasting shift, with the U.S. economy once again demonstrating far more resilience than most had expected.

This potential shift was further undone by a red sweep in the November elections, with the incoming administration’s broadly pro-growth and pro-inflation policies. Mortgage rates—and all fixed income instruments—tend to drop when growth and inflation fall below expectations. Yet, despite all the movement throughout the year, mortgage rates ended 2024 exactly where they began: at 6.875%.

One response to “2025 mortgage interest rate forecast”

Thanks Kyle,

Always such great informative information.