You’re shopping for a mortgage and want the best rate possible—but what if there’s a little-known way to save even more?

Back in 1977, President Jimmy Carter enacted the Community Reinvestment Act (CRA) to help low- and moderate-income (LMI) buyers access more affordable home loans. Lenders are incentivized by the government, through the CRA, to fund loans in certain areas or to borrowers with incomes below a specific threshold.

At Tomo, we pass those rewards along to buyers in the form of lower mortgage rates or reduced fees–it’s only fair, right? Unfortunately, most lenders pocket that extra savings. This emphasizes how important it is to shop for a lender that will give you a fair rate.

How much can you save?

The incentives banks receive can translate into lower mortgage rates for eligible buyers, saving you as much as 0.50% on your rate.

Suppose you’re taking out a $450,000 mortgage. At a 7% interest rate, your monthly payment would be around $2,994, while at a 6.5% interest rate, it drops to $2,844. That’s a difference of $150 per month.

Here’s how that adds up over time:

- After 5 years, you’d save approximately $8,973.

- After 10 years, the savings grow to about $17,947.

- Over the full 30-year term, the total savings would reach an impressive $53,840.

The bottom line: CRA-eligible buyers could get a much better deal on their mortgage, but only if a lender decides to give you a better deal.

How do you know if you qualify for a CRA program?

It depends on either your income or the location of your property.

The CRA is focused on helping low- and moderate-income buyers. For example, in Atlanta, the Area Median Income (AMI) for a family of four is $96,400. If your income is less than $48,200 (50% of the AMI) or $77,120 (80% of the AMI), you’re likely eligible. In Houston, the AMI for a family of four is $90,100, so the income limits are $45,050 and $72,080, respectively.

If you want to check income eligibility for a specific property, the Fannie Mae AMI Lookup Tool can be helpful. This tool allows you to confirm income thresholds for a property’s location and determine if you meet the requirements. You’ll enter the property address to see the AMI for the area and the corresponding thresholds (e.g., 50%, 80%).

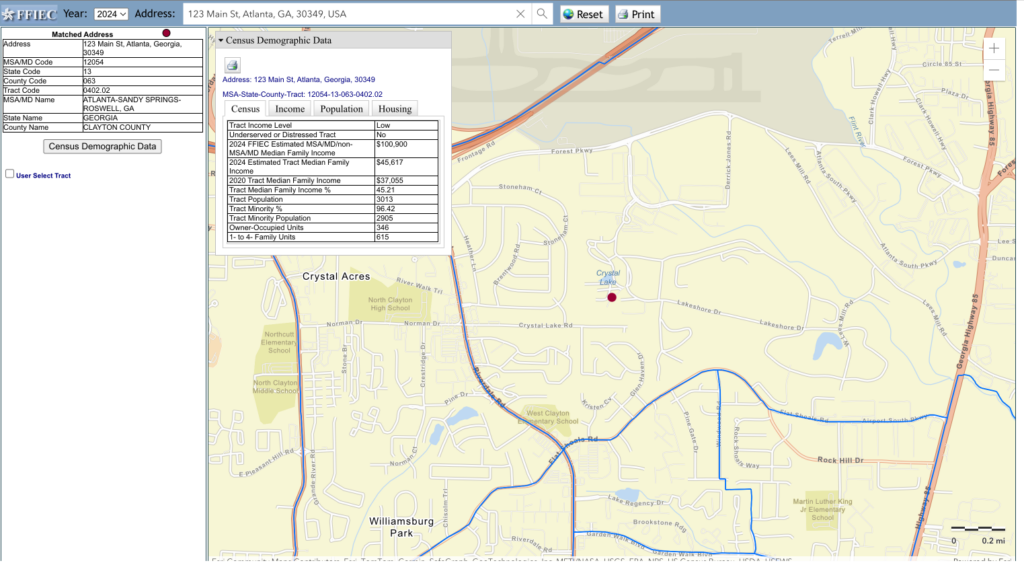

If you’re above the income limits, don’t worry—you might still qualify based on the location of the home you’re buying. Certain neighborhoods, especially those classified as low- or moderate-income (LMI) census tracts, are automatically eligible for CRA benefits, even if your income doesn’t meet the threshold. You can check if a property is in one of these areas by using the FFIEC Geocoding/Mapping System. In Atlanta, many neighborhoods within the I-285 perimeter fall into these zones, and in Houston, areas like the Fifth Ward and East End often qualify.

It’s a little complicated on the FFIEC website, so here’s a step-by-step guide:

- Go to the FFIEC Geocoding System (this tool)

- Set the Reporting Year (2024)

- Enter the address of the property you’re interested in buying and click “Search” or “Geocode Address” to see your results.

- On the results page, expand the Census Demographic Data section (it might be collapsed).

Look for the field called Tract Income Level. If it says Low-Income or Moderate-Income, your property is likely CRA-eligible.

Final thoughts

The Community Reinvestment Act might not be on every homebuyer’s radar, but it should be. If you’re a first time home buyer exploring where to move, consider whether your target neighborhood is in a low-income or moderate-income census tract. Or check to see if your income is above or below the median income level in your target neighborhood.

By understanding how CRA incentives work, you can tap into a program designed to make homeownership more accessible—and save big on your mortgage in the process.If you’re curious about how the CRA could help you save, our team here at Tomo Mortgage can help you make sure you take advantage of the lowest rates possible. Start your application today, and we’ll make sure you’re getting every possible advantage.

If you’re ready to start your journey to homeownership, get pre approved with Tomo Mortgage today.