Right now, about 9 in 10 home buyers in America pay too much for their mortgage. Without knowing it, people pay steep fees and higher rates than other people in the exact same financial circumstances.

Imagine two identical people want to buy the exact same house. They have the same credit score and income, debts, and everything else. Due to deceptive sales practices that are incredibly common (and used by the biggest lenders in America), one of these people might pay as much as $20,000 more than the other for the exact same loan. It’s bananas.

To help people get a fair deal, we wanted to expose some of the tricks and practices big lenders use to disguise or misrepresent the numbers that are in a Loan Estimate.

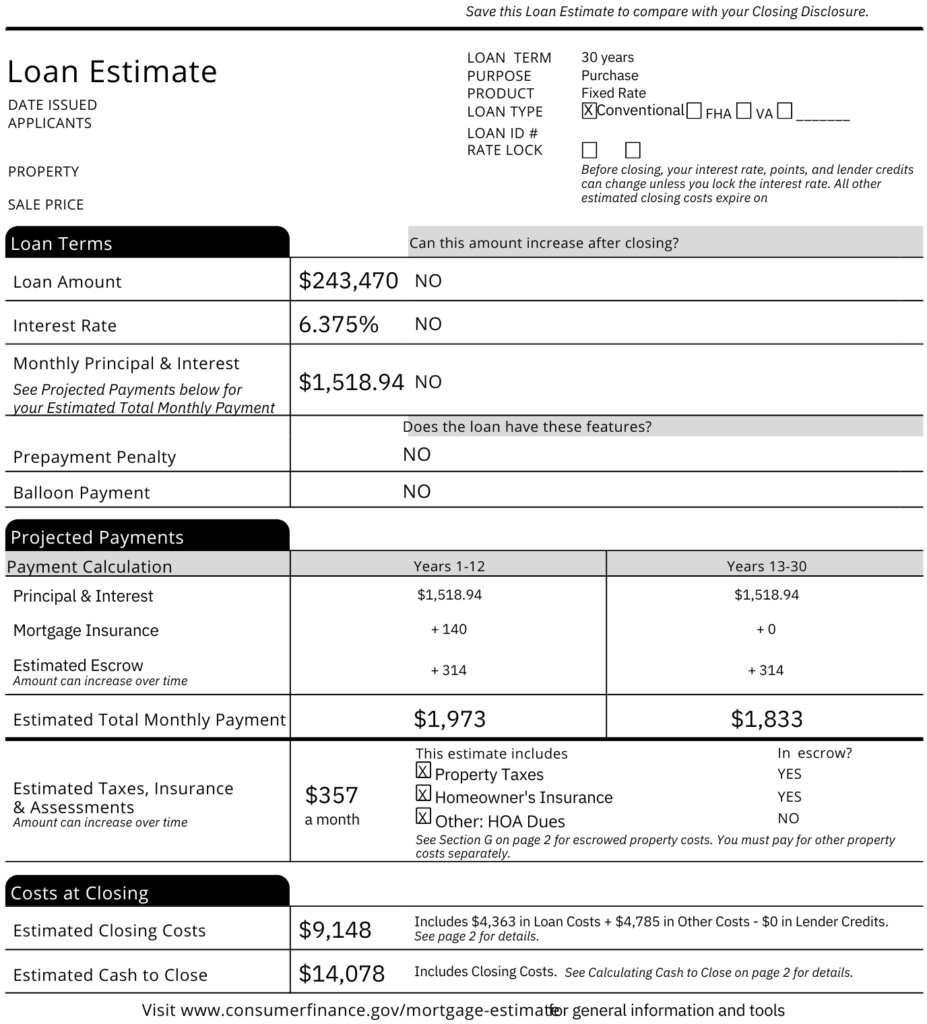

Let’s break down what’s in a Loan Estimate

When you look at a loan estimate, it can be a lot to take in, especially if it’s your first time. There are so many categories, and without experience or some real study, it’s hard for most buyers to feel confident distinguishing a good deal from a rip-off. Lenders know this and may take advantage by shifting costs and downplaying certain fees. Here’s what you should pay attention to…

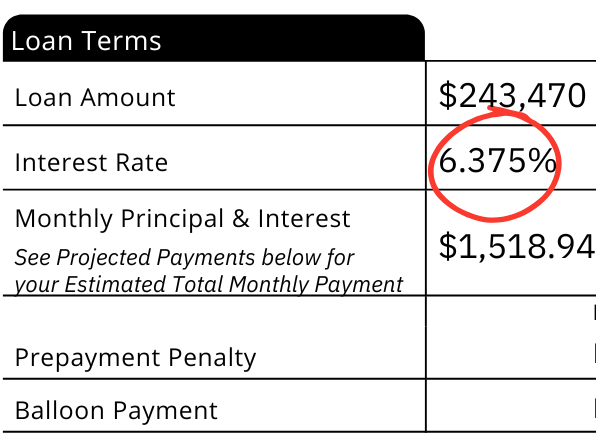

Interest Rate

This matters, of course, but any lender anywhere can charge you more or less for a specific interest rate. It’s referred to as “buying points,” where there’s an upfront cost to get a specific rate. If you have $0 associated, that’s called a “par rate.” Sometimes it’s a good idea to buy points—if you don’t plan to move or refinance in the next 5 years, such as when interest rates are especially low. But points aren’t always a good idea, financially. Our research shows that while a majority of buyers get points, very few know what they are or even whether they’re a good investment. So while it’s tempting to look at the interest rate at face value, remember that it’s not the whole story. For that, you need to take a trip to Section A.

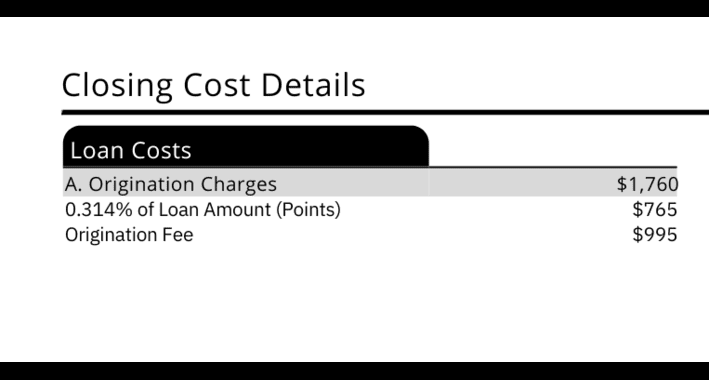

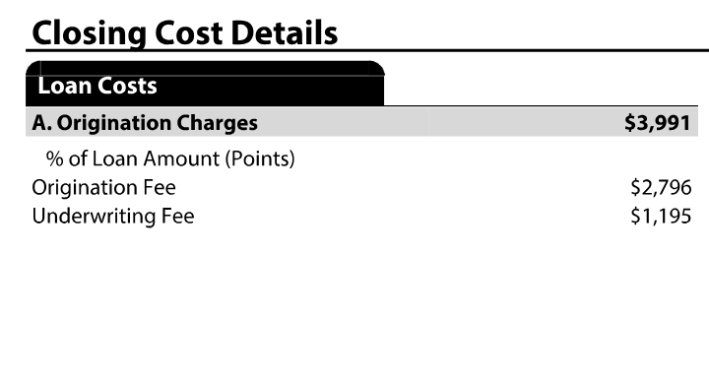

Section A

Loan points: This section is key for comparing lenders. It details what you’re paying to get the interest rate shown. You may have chosen to buy points to lower your rate, which would show as a fee here. Alternatively, you could have opted for lender credits (increasing your rate) to offset upfront closing costs, appearing as a credit here.

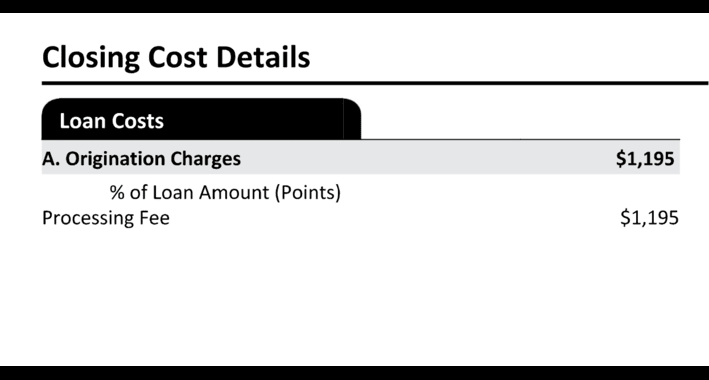

Origination fees: What you likely didn’t choose are the origination fees (sometimes called underwriting or processing fees) listed below the points charge. Most lenders charge thousands in these fees as a “thank you” for choosing them.

Here are three examples of that fee worded differently.

We don’t mean to brag (too much), but here at Tomo Mortgage, we think this fee is unfair and, frankly, highway robbery. That’s why the origination or underwriting fee will always be $0 on your loan estimate from us–as it should be.

Cost at closing

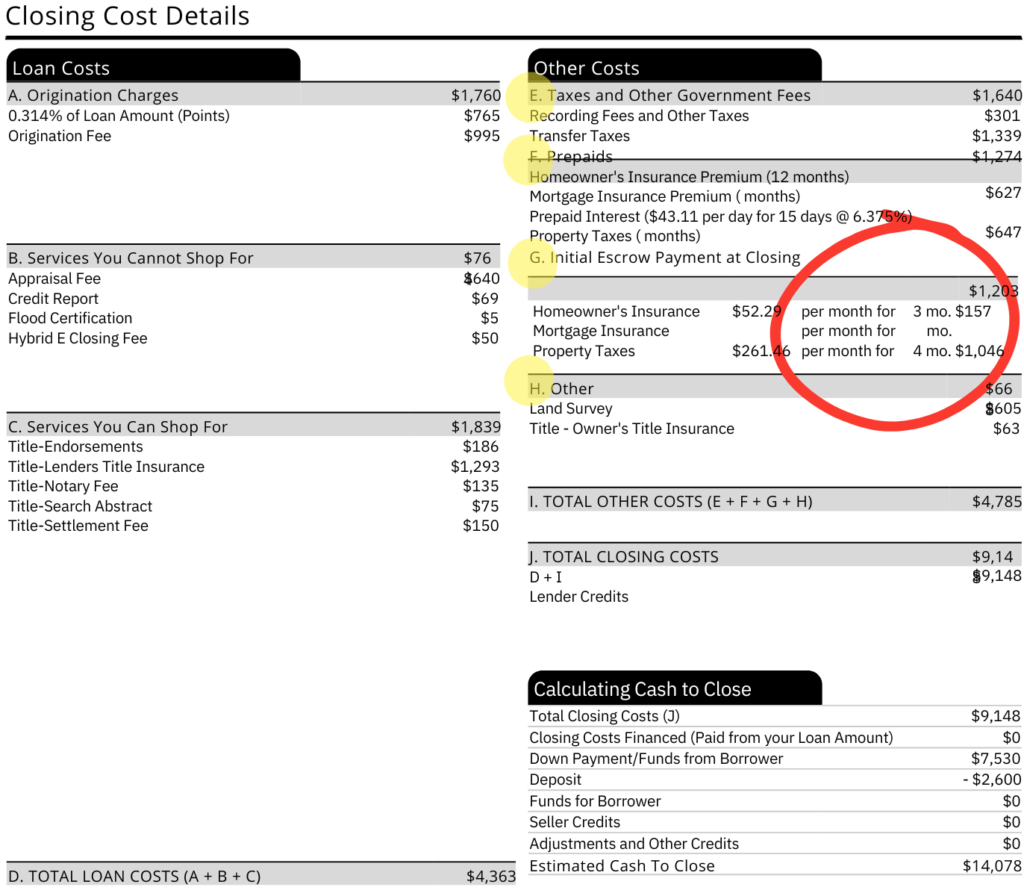

Many lenders emphasize just the interest rate or out-of-pocket closing costs—it seems logical, right? But those aren’t the only important numbers to watch. How your lender calculates “cash to close” matters a lot, and unfortunately, this number can often be manipulated to appear lower than what you’ll actually pay at closing.

One common trick is underestimating costs in sections E, F, and G of the Loan Estimate—where taxes, insurance, and escrow are listed. These numbers are technically estimates, but some lenders deliberately lowball them. Then, when it’s time to close, borrowers are surprised by thousands of dollars in unexpected charges.

Here’s how it happens:

Escrow and prepaid costs: Some lenders list fewer months of taxes and insurance reserves than you’ll really need. For example, they might show just three or four months of property tax escrow when six months is typical. That makes the upfront “cash to close” number seem lower—until the final closing disclosure reveals the true amount.

Title costs and third-party fees (Section C): Lenders may also underestimate title insurance and settlement fees. Later, they blame the difference on the title company or your real estate agent’s choices, even though the initial underestimation made their offer look artificially cheaper.

Earnest money deposit: If your purchase agreement isn’t finalized when the Loan Estimate is issued, some lenders leave out your earnest money deposit. This omission inflates the “cash to close” figure and can cause confusion later when the real math catches up.

Always look carefully at Sections C, E, F, and G in your first Loan Estimate—not just the interest rate—to get a real sense of what you’ll owe at closing.

When things don’t add up

At closing, it’s all too common to hear lenders say, “that was just an estimate” if costs turn out higher than expected. In reality, these estimates were often intentionally understated to keep clients progressing down the mortgage process until it’s too late to switch—by then, clients may have too many sunk costs, like a home inspection, appraisal, title, and earnest money deposit.

And if you haven’t done it before, this is where they get you

The truth is, most people only go through the mortgage process once or twice in their lifetime (I mean, how many of us are getting so many mortgages that we become experts?). It’s complex, and lenders know that the unfamiliarity and inaccessibility of these details give them an advantage. Many often rely on this knowledge gap to manipulate costs, turning what should be a straightforward process into a maze of fees and hidden charges.

That’s why it’s crucial to know how to read each section of the loan estimate and understand how costs might change—so you’re not caught off guard or locked into an expensive loan.

Transparency should be the standard, not the exception

Unfortunately, not every lender is forthcoming about what you’ll really pay and whether their loan is really a good deal. Honesty and transparency can be really hard to find.

We’re working to change all that, one loan estimate at a time.

If you’re ready to start your journey to homeownership, get pre approved with Tomo Mortgage today.