Rates dip to 6.5%

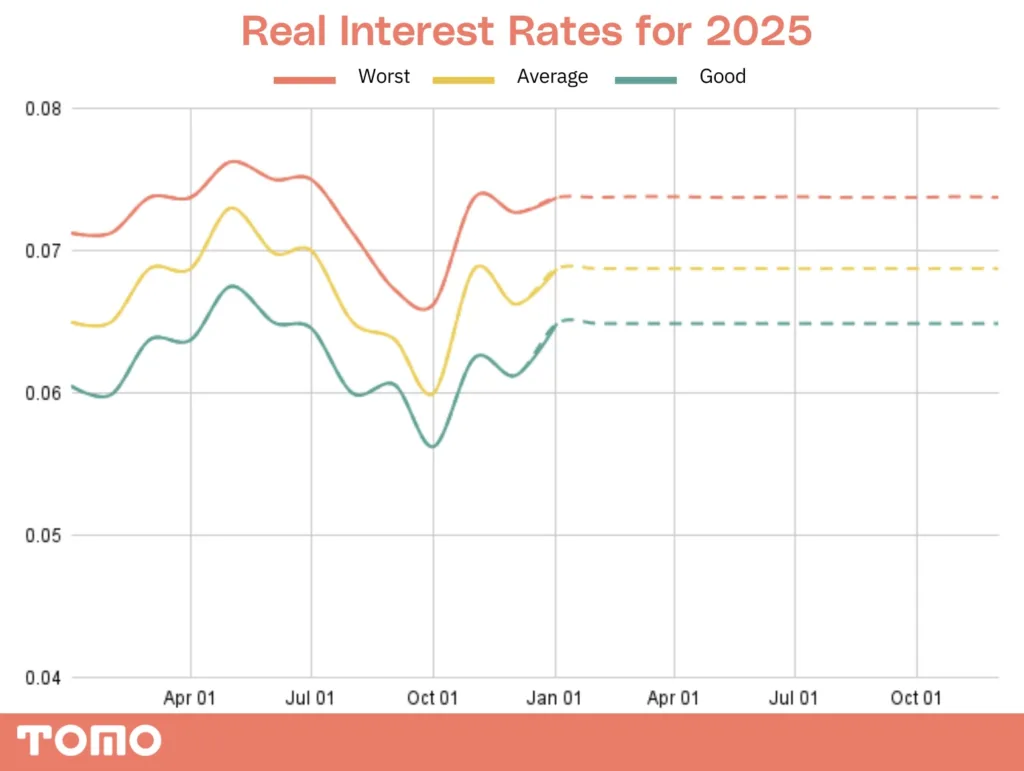

The chart above shows real interest rates locked for 30-year conventional loans for people with good credit by over 1,000 different lenders over the course of 2024, and the dotted line is our projected forecast for 2025 (rates looking like they’ll hold pretty steady around 6.875% at the wrap of each quarter).

The average rate, or 50th percentile, serves as a key marker for rate shoppers. It represents the point where half of borrowers locked in rates below and half locked in rates above, whereas the red worst line, shows the 95th percentile, or “rip off rates” that unfortunately some lenders will offer.

If this graph conveys one thing its that the most important thing homebuyers can do in 2025 to get a lower rate is to shop around between lenders.

2025 Outlook

| Quarter | Tomo prediction | Actual |

|---|---|---|

| Q1 2025 | 6.875% Est | |

| Q2 2025 | 6.875% Est | |

| Q3 2025 | 6.875% Est | |

| Q4 2025 | 6.875% Est |

2025… The market consensus is forecasting a slight drop in mortgage rates, from nearly 7% today to 6.5% by the end of the year. The Federal Reserve is signaling two rate cuts, but it’s important to remember that the Fed does not directly control mortgage rates. At Tomo, we believe the market is overly optimistic in its mortgage rate forecast and expect rates to end the year close to where they are now: 6.875%.

Key factors driving rates in 2025:

- The labor market: the labor market will continue to drive inflation outcomes and influence Fed policy. So far, it shows no signs of slowing down.

- Fiscal and regulatory policy: fiscal and regulatory actions will play a larger role in shaping mortgage rates than the Fed’s monetary policy. Key areas we are monitoring include:

- The prospect of mass deportations: this could tighten a labor force that has just returned to balance.

- The effect of tariffs: tariffs are inherently inflationary.

- The potential exit of Fannie Mae and Freddie Mac from conservatorship: this remains the largest wildcard outside the macroeconomy.

The odds of seeing mortgage rates dip into the 6s are not in favor. The latest Freddie Mac mortgage survey showed 30-year fixed mortgage rates at 6.91%. Historically, the odds of a drop of 0.91% or more from the first week of the year are slim—only about 25% of the time (13 out of 53 years) has this happened. Moreover, the risks for rates remain to the upside.

What happened with rates last week?

Mortgage rates dipped by another 0.125% last week, as unemployment ticked up and the Trump Administration continued to create uncertainty around the economic environment. Going into the New Year, most economists believed the Trump Administration would decisively implement tariffs, but the continuous imposition and reversals have unnerved all economic participants. Rather than promoting pro-growth, pro-inflationary policies, the Administration could be tipping the economy into recession through spending and job reductions, while not following through on many of the tariff promises made originally. As a result the expectations of reduced growth are benefiting bonds and mortgage rates, sending both lower.

What might cause rates to increase or decrease this week?

This week, we have limited economic data to review. On Tuesday, the JOLTS report (a labor market report) will be released, but it carries less significance—especially since it comes out after the BLS Labor Market Report this month. The most important release to watch is on Wednesday: the Consumer Price Index (CPI).

Here’s what to keep an eye on:

February JOLTS Job Openings (Tues – 10:00am) This survey by the Bureau of Labor Statistics measures job vacancies. Typically it is released a few days ahead of the Labor Market Report, which contains the unemployment rate, but this month it is being released afterwards. It typically has less market significance than the larger Labor Market Report, and this month will be inconsequential unless we see a large deviation from the expected 7.71MM vacancies.

February Consumer Price Index (Wed – 8:30am) Core CPI is forecast to slow from 0.4% to 0.3%, which is still too high for the Fed’s liking. While traders may react to this number initially, the policy decisions from the Trump Administration on tariffs are far more important to future policy than an inflation reading that took place a month prior.

Weekly Jobless Claims (Thurs – 8:30am) While this is weekly data rather than monthly, and less impactful on a week-to-week basis, the weekly claims still are a signal of labor market strength/weakness. In recent months this release has trended closer to 220,000 than 200,000 indicating a gradual weakening of the labor market. Economists forecast a slightly higher 234,000 this week, signaling a sentiment shift to potentially higher unemployment.

Current mortgage rates

You can see personalized rates on our current mortgage rates page (we promise they are real rates for real people).

| Product | Rate-March. 10 | Rate-March. 5 | Change |

|---|---|---|---|

| 30 Year Fixed | 6.50% | 6.625% | 0.125% lower |

| 30 Year Fixed – VA | 6.0% | 6.0% | no change |

| 30 Year Fixed – FHA | 6.125% | 6.125% | no change |

| 30 Year 7/6 ARM | 6.5% | 7.125% | 0.625% lower |

| 15 Year Fixed | 5.75% | 5.875% | 0.125% lower |

2024 Lookback

| Quarter | Tomo prediction | Actual |

|---|---|---|

| Q1 2024 | 6.875% | 6.875% |

| Q2 2024 | 6.625% | 7.0% |

| Q3 2024 | 6.5% | 6.5% |

| Q4 2024 | 7.0% (revised from 6.375%) | 6.875% |

2024 marked the second consecutive year that began with market consensus forecasting a steep drop in interest rates as the year progressed. While I didn’t expect rates to fall into the 5s, I also anticipated a downward shift throughout the year. In August 2024, we experienced what I described as a “macroeconomic shift,” prompted by a notably weak Labor Market Report that seemed to provide the data the Fed needed for a true pivot. Unfortunately, that report turned out to be more of a blip than a lasting shift, with the U.S. economy once again demonstrating far more resilience than most had expected.

This potential shift was further undone by a red sweep in the November elections, with the incoming administration’s broadly pro-growth and pro-inflation policies. Mortgage rates—and all fixed income instruments—tend to drop when growth and inflation fall below expectations. Yet, despite all the movement throughout the year, mortgage rates ended 2024 exactly where they began: at 6.875%.

One response to “2025 mortgage interest rate forecast”

Thanks Kyle,

Always such great informative information.