TrueRate uses AI to model your “true rate,” combining your specific loan scenario and the latest market information.

It uses unique public and private information about homebuyers’ loans to evaluate lenders who give good (30th percentile), “average” (50th percentile), or “bad” (70th percentile) rates on 30-year fixed rate, conventional, conforming mortgages for primary residences. (This is the largest segment of the US mortgage market.)

We use publicly available data as well as private and proprietary data to help people compare rates apples-to-apples. Our calculations incorporate the most important factors in mortgage pricing, including when you “lock-in” an interest rate, FICO Score, Occupancy Type, and Discount “Rate” Points. Unlike other mortgage rate comparison sites, our model derives market percentiles directly from empirical data rather than advertised values.

Since we don’t have direct relationships with any other mortgage lenders, we can’t guarantee the lenders will ultimately provide a rate to you that matches their historical norm.

TrueRate Accuracy

We’ve tested and validated our model in two key ways. Benchmark Tracking – Does our model yield similar results to 3rd party benchmarks? And Control Effectiveness – When we say we’re controlling for variables in the loan scenario, does the model sufficiently capture the nuances of how each variable impacts market rate? Here’s how our model performed.

This chart looks at the Mean Absolute Error between our modeled 50th Percentile Rate and the Freddie Mac 30-year Fixed Rate is 0.032 basis points, mapping nearly exactly to the historic norm over a multi-year span.

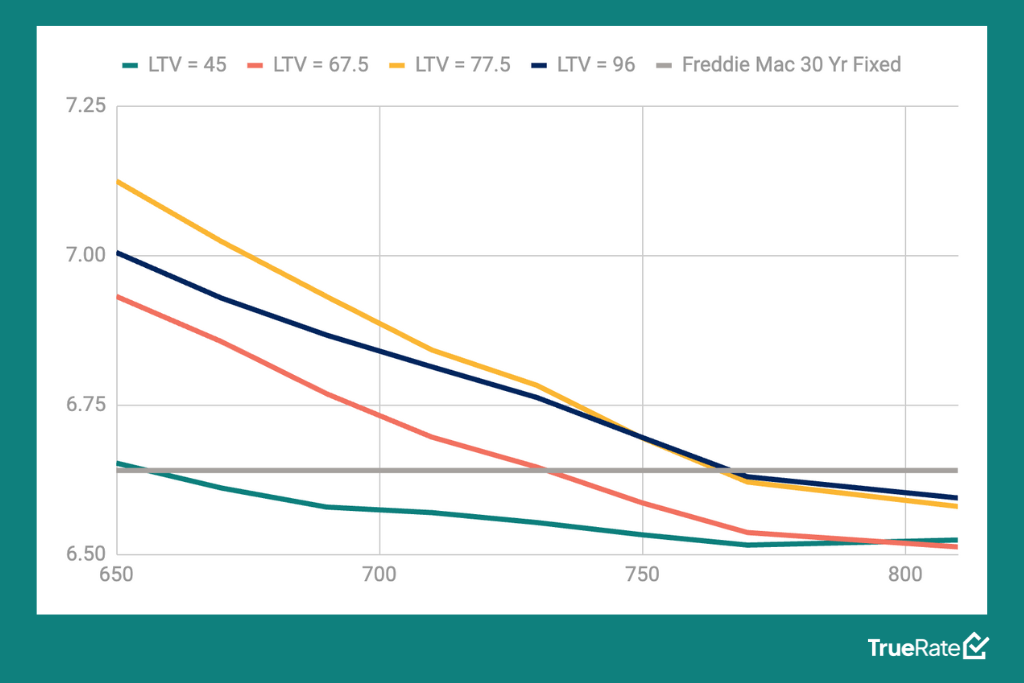

In this chart, we show that the model effectively controls for the variation in Loan-to-Value (LTV) ratio, at 45%, 67.5%, 77.5%, and 96%, as well as the credit score ranges.

Share Your Experience

Our intent is for TrueRate to be an educational tool. By giving homebuyers a true rate, we can help them find the right lender for them with an apples-to-apples comparison. While we know it will be helpful for home buyers, we suspect some mortgage lenders might not be so pleased with what the historical data is showing.

Please let us know what you think about TrueRate by emailing us at truerate@tomo.com. We would love to hear your thoughts!