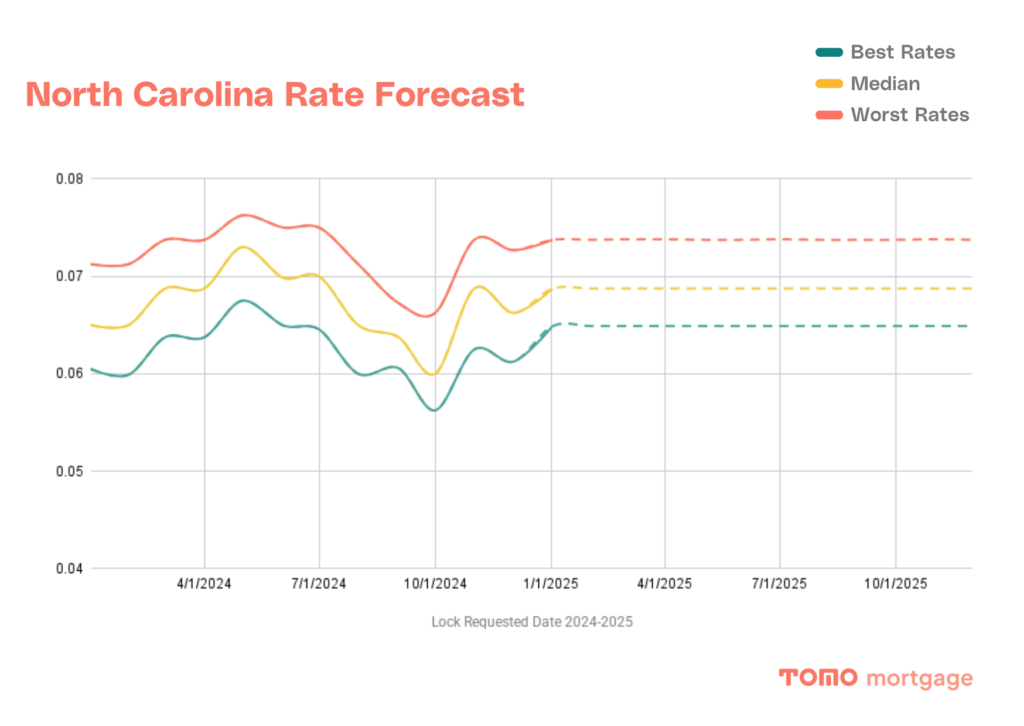

The chart above shows real interest rates locked for 30-year conventional loans in North Carolina for people with great credit (FICO score of 740+) by over 1,000 different lenders. The dotted line is our projected forecast for 2025, with rates looking like they’ll hold pretty steady nationally around 6.875% at the wrap of each quarter.

What is a good interest rate for home buyers in Durham right now

With home prices high, even a slight dip in interest rates can be a meaningful reduction in monthly payment.

If you’re looking for a home in Durham and have good credit and sufficient income (a FICO credit score between 720 and 740), a typical buyer should target less than 6.875% to ensure they are getting a competitive rate on their mortgage.

Will interest rates go down in 2025?

For 2025, the market consensus is forecasting a slight drop in mortgage rates, from nearly 7% today to 6.5% by the end of the year. The Federal Reserve is signaling two rate cuts, but it’s important to remember that the Fed does not directly control mortgage rates.

At Tomo Mortgage, we believe the market is overly optimistic in its mortgage rate forecast and expect rates to end the year close to where they are now: 6.875%.

Key factors driving rates in 2025:

- The labor market: the labor market will continue to drive inflation outcomes and influence Fed policy. So far, it shows no signs of slowing down.

- Fiscal and regulatory policy: fiscal and regulatory actions will play a larger role in shaping mortgage rates than the Fed’s monetary policy. Key areas we are monitoring include:

- The prospect of mass deportations: this could tighten a labor force that has just returned to balance.

- The effect of tariffs: tariffs are inherently inflationary.

- The potential exit of Fannie Mae and Freddie Mac from conservatorship: this remains the largest wildcard outside the macroeconomy.

The odds of seeing mortgage rates dip into the 6s are not in favor. The latest Freddie Mac mortgage survey showed 30-year fixed mortgage rates at 6.91%. Historically, the odds of a drop of 0.91% or more from the first week of the year are slim—only about 25% of the time (13 out of 53 years) has this happened. Moreover, the risks for rates remain to the upside.