The term points gets frequently thrown around, but what do points actually mean and should you get them?

So what are points anyway?

Mortgage “points,” also referred to as discount points, are upfront fees paid to your lender at the time of closing on your property. You pay a fee to your lender for the point in exchange for the lender giving you a reduced interest rate on your loan. The typical point costs about 1% of your loan. So on a $400,000 loan, one point equals $4,000.

In this example the loan is for $400,000. So one point = 1% of your loan. That is $4,000 per point, and we will assume that buying 1 point reduces your interest rate by .25%.

| Number of Points Purchased | Interest Rate | The Total Cost of Points (Upfront Cost) | Monthly Payment | Monthly Savings | Break-Even Period (Months) | Break-Even Period (Years) | Savings after 5 Years | Savings after 8 Years | Savings After 10 Years |

| 0 | 6.5% | $0 | $2,528.74 | NA | NA | NA | $0 | $0 | $0 |

| 1 | 6.25% | $4,000 | $2.487.52 | $41.22 | 97 | 8.08 | -$1,5256.80 | -$702.88 | $946.40 |

| 2 | 6% | $8,000 | $2,446.12 | $82.62 | 96.8 | 8.07 | -$3,043.53 | -$1,390.53 | $870.90 |

| 3 | 5.75% | $12,000 | $2,405.43 | $123.31 | 97.5 | 8.12 | -$4,560.60 | -$2,078.53 | $1,306.04 |

| 4 | 5.50% | $16,000 | $2,364.46 | $164.28 | 97.6 | 8.13 | -6,077.88 | -$2,766.53 | $1,741.70 |

| 5 | 5.25% | $20,000 | $2,323.20 | $205.54 | 97.6 | 8.13 | -$7,595.36 | $3,454.53 | $2,177.27 |

Points can make understanding which loan offers are competitive… murky. You might see a low advertised interest rate, but securing that rate could require purchasing points, costing thousands of dollars upfront. This “bait and switch,” tactic, is frustratingly common for home shoppers who are just trying to find the best savings.

What does purchasing a point do?

Purchasing a point lowers your interest rate, generally between .25% and .5%. To paint a real world picture, if your monthly payment was around $1,900 a month with a 6.5% rate, if you bought your loan down by .25%, your monthly payment would be around $1,850 with an interest rate of 6.25%.

Buying one point on a $300,000 loan would be $3K, a $400,000 loan $4k, a $500,000 loan one point is $5K etc.. One way to think about it is that you are trading an upfront cost for a monthly fee. Pay an upfront cost by buying point to have a lower monthly payment or have a higher monthly payment but no upfront fee by skipping the points.

Should I buy points?

It depends, paying $4,000 upfront could be a lot, especially if you are already focused on saving for a down payment.

Say you truly plan to keep your mortgage for the full 30 years, then you could save over $15,000 by buying a point. This scenario would make sense might be if you locked in a competitively low rate, and it is unlikely you would find a lower one in the future, causing you to want to hold onto this property long-term.

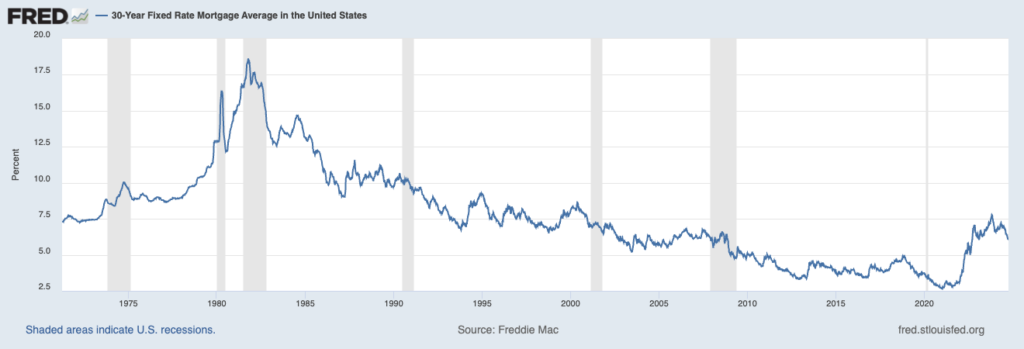

Contrastingly if rates are high at the time of your purchase or if you envision having a higher credit score in the future or less debt, staying away from points, and staying open to refinancing down the line would be a smart bet.

Here is a graph from FRED, (Federal Reserve Economic Data) highlighting the average 30-Year Fixed Mortgage Rate in the U.S.

Most people don’t keep their loans for 30 years. The average mortgage lasts about 8 years before the homeowner sells or refinances to get a lower interest rate. The benefit of purchasing a point diminishes if you are not going to realize the extent of the possible savings from buying it, so if that sounds like you we would advise not purchasing points.

For the typical homebuyer, we would recommend being very critical before choosing to buy points if you do at all.

How do I calculate the break-even point for mortgage points?

Divide the cost of the points by the amount you save on your monthly payment. This will give you the number of months it will take for the savings to cover the upfront cost of the points.

Are there different types of points?

There are two main types: discount points and origination points. Discount points reduce your interest rate, while origination points are fees charged by the lender for processing the loan.

Discount points are what you think of when you see points referenced to “buy down your rate,” and are tax deductible as mortgage interest, while origination points are compensating the lender for processing the loan/ aka doing their job, and are not tax deductible. (We would never charge origination points, and recommend you don’t buy them).

How does buying points impact my upfront cost?

If you decide to purchase points, you will see the cost of the point(s) in your closing costs at the time of purchase for your home. Making sure to budget for your closing costs and additional expenses is a key factor of factoring in all of your costs.

Conclusion

Overall, for most homebuyers, we recommend avoiding buying points—especially if you plan to sell before breaking even on the cost or if you anticipate refinancing for a lower rate in the future.

When deciding whether to purchase discount points, consider how long you plan to stay in your home, the interest rate you’re being offered, your current financial situation (or whether you expect it to improve), and how long it would take you to break even on the cost of the points.

If you have any questions about points, or would like to discuss a specific scenario, please feel free to reach out to one of our pre approval advisors at: 737-510-2523 via phone call or text.

If you’re ready to start your journey to homeownership, get pre approved with Tomo Mortgage today.