Buying a home isn’t just about finding the right place—it’s about feeling ready financially. And that’s not easy right now. Saving is tough for nearly everyone, with higher costs for basics like food, rent, and transportation and. At the same time, the pressure to spend on everyday comforts hasn’t gone away.

Looking at how Americans save and spend can give useful perspective. It shows what most people are up against, where small adjustments could free up cash, and how smart choices—especially on your mortgage—can make the biggest difference.

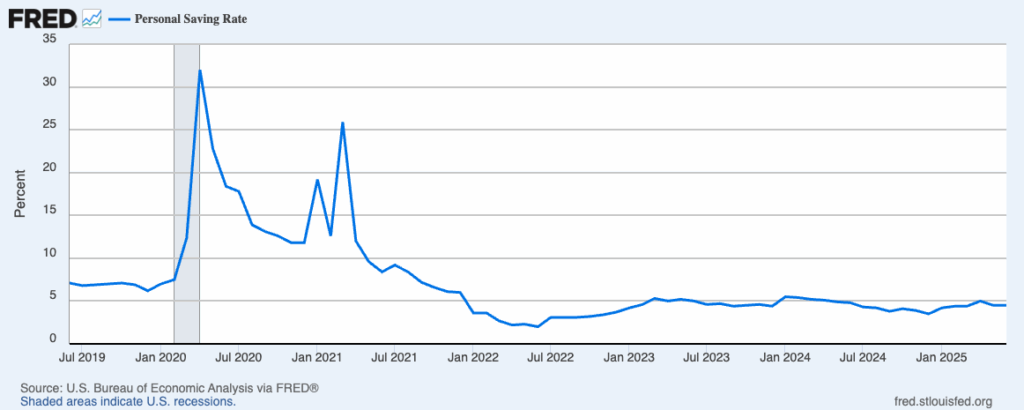

The chart below from the Federal Reserve shows the U.S. personal saving rate — the percentage of disposable income people set aside each month. You can see how saving spiked during COVID, when people were stuck at home, then dropped back down. Today, the saving rate hovers around 4–5%, which is low by historical standards.

This context is important: struggling to save isn’t unusual right now. It’s part of the financial climate most Americans are facing, not just an individual challenge. And while building savings takes time, comparing mortgage lenders to avoid overpaying on interest can free up just as much—or more—than cutting everyday expenses. Get your finances in order.

1. How much people have saved

- The typical American has about $8,000 in savings.

- More than half say they couldn’t cover a $1,000 emergency without borrowing (Bankrate).

- That doesn’t mean people are failing—it shows how common it is to be stretched thin while still trying to prepare for big goals like homeownership.

2. Where the money goes

Most paychecks go to necessities: housing, groceries, and transportation (BEA). But smaller, routine spending adds up too:

- About $1,200 a year on subscriptions (streaming, apps, gyms).

- Around $3,500 a year on dining out and delivery.

That’s nearly $5,000 a year—not “wasted” money, but a reminder of how everyday choices can shift into home savings if and when you want them to.

3. Small changes, real progress

You don’t need to cut everything at once. Even small adjustments matter:

- Saving $200 a month (roughly what many spend on takeout and subscriptions) equals $2,400 a year.

- Over three years, that’s $7,200—almost the same as the typical American’s entire savings balance.

- For a $300,000 starter home, $7,200 already covers about half of the minimum FHA down payment.

4. The bigger choice: your mortgage

Trimming spending helps, but the biggest money decision most buyers face is the mortgage itself. The interest rate you choose has a lifelong impact.

- Paying even 0.5% more on a $300,000 loan adds over $30,000 in extra cost across 30 years.

- Tools like TrueRate help you compare offers so you don’t spend more than necessary on interest—freeing up money for savings, renovations, or life itself.

5. Why this matters for homebuyers

| Scenario | Money Saved | Impact on Homebuying |

| Setting aside $200/month | ~$2,400 per year | Builds a down payment fund steadily |

| Three years of consistent saving | ~$7,200 | Covers half of a minimum FHA down payment |

| Avoiding 0.5% higher mortgage interest | $30,000+ over loan life | Pays for closing costs many times over |

6. Making it tangible: roadmap

- Track where your money goes. Knowing your real numbers makes it easier to spot room for saving.

- Automate what you can. Small, regular transfers to savings work better than one-off efforts.

- Build a cushion. Aiming for more than the typical $8,000 helps with closing costs, moving, and unexpected repairs.

- Shop your mortgage. Saving on interest is just as powerful as saving on daily expenses. TrueRate makes it easy to see if you’re overpaying.

Bottom line for homebuyers

Saving for a home is hard, and the numbers prove you’re not alone in feeling stretched. But the facts also show there are real opportunities: small, manageable changes in spending can build a down payment, and choosing the right mortgage can save tens of thousands. That’s the kind of saving vs. spending decision that puts homeownership within reach.