Think it would be impossible to get a 3% interest rate on your next home? Think again. In this post we’ll explain what an assumable mortgage is and show you how to find thousands of homes with assumable mortgages with our new home search engine.

What is an assumable mortgage?

An assumable mortgage is a loan that can be transferred from seller to buyer. You know there are tons of sellers out there with low interest rates. If those interest rates are on assumable mortgages, they can be yours! With an assumable mortgage, the buyer takes over the seller’s loan including their interest rate, mortgage payment, and term. This is huge! That’s because the difference in interest rate between the seller’s loan and what the buyer can get today can mean a difference in hundreds of dollars of interest payments a month—and hundreds of thousands of dollars over the life of the loan.

Let’s look at an example: say you wanted to purchase a home with a $350,000 list price. That home has a 3.5% 30-year fixed FHA mortgage that the current owner has been paying for 3 years, and it has a $300,000 remaining balance. If you took out a new 30-year fixed mortgage today at 7% for that loan amount, you would have monthly payments of $1996. If you assumed the seller’s 3.5% mortgage, your monthly payments would be $1433. That’s $563 back in your pocket each month.*

Keep in mind that, since you would be assuming the seller’s loan balance, you would need to cover the seller’s equity in the home and any appreciation with cash or a second mortgage. If you offered the list price on the home in our example above, that means you would need to close a $50,000 gap ($350,000 list price – $300,000 assumed loan amount) at closing. This might make assumable mortgages where the seller has substantial equity in the home less attractive.

Are there many home listings that have an assumable mortgage?

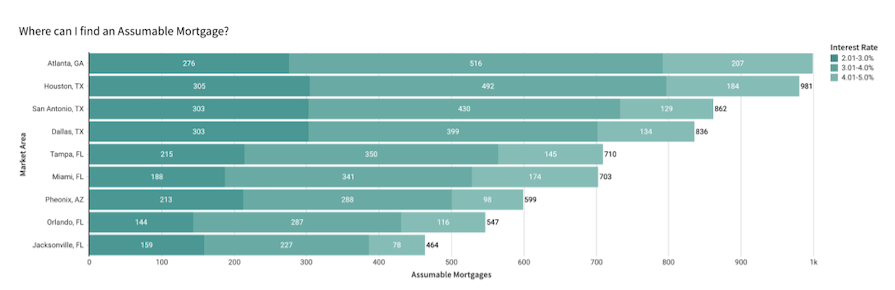

Assumable mortgages are not the norm in the US, but they aren’t as rare as you might think. Government loans such as FHA, VA, and USDA (1 in 5 loans depending on the market) are by default assumable mortgages. We sampled mortgage data in several major metros in the US and found there are thousands of actively listed homes with assumable mortgages with rates under 5%. Almost a third of these mortgages had rates under 3%!

Source: Public Records Data, Listings Active as of Feb 22, 2024

How can I find out if the house I’m interested in has an assumable mortgage?

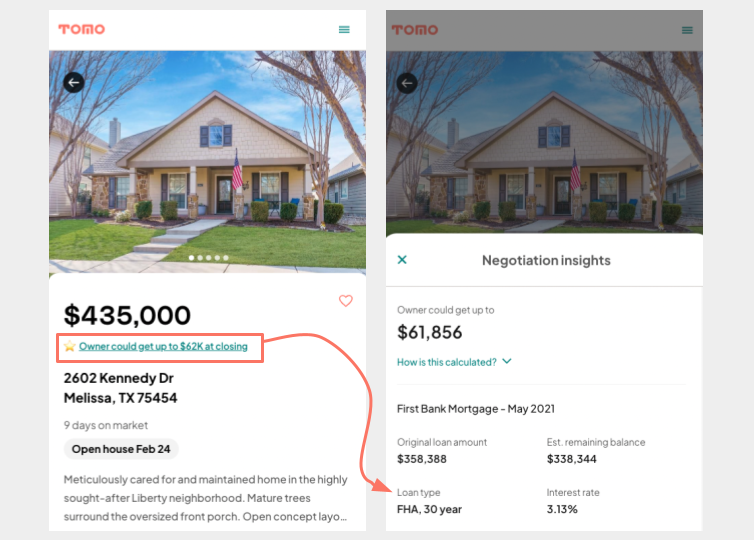

FHA, VA and USDA loans are generally assumable. Another easy way to see which homes have an assumable mortgage is to check out our new assumable mortgage topic page which lists all the cities and homes with this type of mortgage. You can then drill down to the city you are interested in, here’s an example of homes with assumable mortgages in Phoenix, Arizona. You can also see Tomo’s estimated remaining balance to get an idea how much seller equity you would have to cover when assuming the loan.

To learn more about assumable mortgages, just reach out to one of our home search advisors at (407) 236-6153. You can also read more on Divvy Homes or the Wall Street Journal.

*Mortgage payment is principal and interest only.

Leave a Reply