Updated January 15, 2024

Who we are

Carey Armstrong is Tomo’s Seattle real estate expert with the acclaim of being Seattle’s most active open house visitor. Her day job as Tomo’s co-founder and chief operating officer influences her strong point of view about Seattle housing policy, prices and direction as well. We promise to pull no punches and tell it like we see it, even if that convinces you not to buy a house.

Summary

Naysayers have claimed that Seattle housing prices are a bubble, but there’s no sign that it’ll burst anytime soon. A modest correction in 2022 has mostly been erased, and declining mortgage rates without corrections to underlying inventory issues will cause prices to grow even faster in 2024.

Buyers are waiting for the bubble to burst

Seattle housing prices have been rising for decades, and for years home buyers have been asking:

- “Is this the top of the Seattle housing market?”

- “When will Seattle home prices stop rising?”

- “Is there a Seattle housing bubble”

- “When will Seattle housing prices fall?”

They point to properties like these, which are by no means unusual, as examples of unsustainable price growth in Seattle:

- A Ballard brick 4br home at 7325 9th Ave NW sold for $1.3m, nearly $150k over asking and almost $1m over its 2009 sale price.

- A 2br Greenlake bungalow at 924 N 78th Street went under contract in 5 days for more than $100k over its $775k asking price – and 5x its 1997 sale price of $175k.

- A 4br in Admiral at 2658 48th Ave SW went for $1.5m in 7 days versus $800k in 2016 and $289k in 1998.

- A 5br Ballard craftsman at 7506 16th Ave NW in Ballard is listed for $1.5m after selling for $1m in 2019, $550k in 2015, and $157k in 1996.

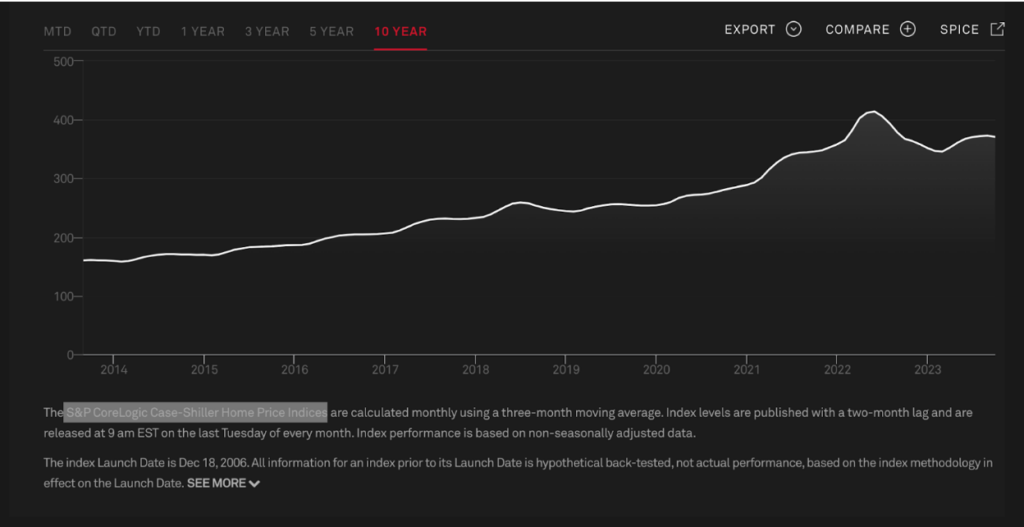

The S&P CoreLogic Case-Shiller Home Price Index shows that the price of housing in the Seattle metropolitan area has grown by 8.71% per year for the past 10 years and is now at 5x what it was in 1996. So a home that was $100,000 in Seattle in 1996 is now $500,000.

What’s driving this growth? The biggest reason for it is population growth: Seattle’s population is 64% larger than it was in 1996 and it was the fastest-growing large city in 2022. Construction has lagged behind population growth for decades, and the housing shortage in the city has gotten worse and worse. Seattle has also become a much wealthier city, with median household income increasing from $35,000 to $115,000.

Many fear there is a bubble that will burst as it did during the 2008 subprime mortgage crisis. There’s even a famous local blog called “The Seattle Bubble.” Buyers who share this belief are sitting on the sidelines licking their chops for a chance to buy if or when this happens.

Buyers in Seattle just can’t catch a break

But the only slowdown Seattle has seen in the past decade was between May 2022 and February 2023. Between these dates, the index fell by 20%. Unfortunately for sidelined buyers, this dip coincided with an increase in mortgage rates.

Let’s say that a home that used to sell for $1,000,000 started selling for $800,000. You’d think that would be great news for the buyer with a pre-approval letter for $800,000, right? Not so fast – because interest rates went from 4% to 7% at the same time, causing the buyer’s payments on a $800,000 loan to go from $3,819 to $5,322.

What can we learn from the dip in prices during this 9-month period? What was going on in Seattle that could have driven this change in housing prices, aside from the obvious change in interest rates that affected the overall US housing market?

Did Amazon’s RTO correct last year’s dip in housing prices?

Perhaps the most obvious reason is the many rounds of layoffs at Seattle tech companies. Tech employment in Washington continued to grow even while layoffs disrupted existing employment, but things were tense and it certainly didn’t feel safe for tech workers to be spending a median $850,000 on a house. (Especially when that $850,000 bought them only 1,500 square feet.)

And what happened in February 2023 to cause things to turn around? Interest rates hadn’t yet started to fall, in fact they continued to rise until October 2023. Perhaps it was Amazon CEO Andy Jassey’s announcement that Amazon employees would need to Return to Office (RTO) on February 17. Not only are there 75,000 Amazon employees in Seattle, but given Amazon’s stock-based compensation and stock appreciation these folks are the ones with the most cash to spend on a house. Amazon has since doubled down on its RTO messaging and told employees it will be checking to see when they scan their badges at offices and that folks who don’t live in Seattle won’t be eligible for promotions.

While this probably isn’t the only factor at play, since then Seattle housing prices have returned to growth and have even recovered by 7%. Were Seattle not in the middle of its annual holiday housing market slowdown, we might see even more of a recovery.

Things are quiet this winter, but just wait until spring

That said, if you’re looking to take advantage of the slow season, check out listings that have been on the market since October and/or had price cuts. For example:

- The West Slope Queen Anne craftsman at 1629 11th Ave W has been on the market since Oct 10 2023 and has already been reduced from $1.35m to $1.30m.

- The 1br condo at the full-service condo building in Ballard at 6535 Seaview Ave NW has been listed since Oct 12 2023 and has been reduced from $565,000 to $558,000.

But with mortgage rates now falling precipitously, we are potentially in for a boom in the spring as buyer purchasing power increases and they are able to get back into the game. With current owners locked into mortgage rates below 3%, existing home inventory is unlikely to grow to match increasing buyer demand. Hello again, bidding wars!

Seattle housing prices will never come back to earth

But back to the original question, “When will Seattle housing prices drop again?” The 2022 dip that’s almost been erased isn’t what buyers were waiting for, so when will their dreams (and sellers’ nightmares) really come true?

First, demand for housing in Seattle could decrease, whether due to overall recession or due to changes in the tech sector that so dominates Seattle employment.

Secondly, supply of housing could increase. Changes to zoning across Washington state to encourage more density could certainly result in more housing units being built in Seattle – where 80% of lots are currently zoned for single-family homes. Or the city could make it easier to build new housing by reducing the red tape required for development.

Third, expansion of Sound Transit’s light rail system may also ease pressure on Seattle proper and the neighborhoods closest to downtown by shortening commutes to and from Seattle’s suburbs.

Are any of these likely to put a significant dent in housing prices in Seattle? No, not really, and certainly not any time soon. Buyers are better off hoping for lower mortgage rates than for substantially lower Seattle home prices – and lower mortgage rates have more impact on their potential purchases anyway.

What can aspiring Seattle home buyers do in the meantime?

Sitting on the sidelines and waiting for prices to drop can be rough, because often it goes in the opposite direction. Home buyers struggling to break into the market should check out options like these that are designed to help:

- Washington State Home Finance Commission (WSHFC) offers a number of down payment assistance programs and homebuyer education programs.

- Community land trusts from organizations like Homestead that convey title to the property along with a long-term lease on the land beneath it, along with significant subsidies.

- Cooperatives from Frolic that mix individual living spaces with more substantial shared amenities than most – for example, shared guest quarters and dining spaces.

- Lenders like Tomo that offer subsidized conventional loans for customers with qualifying income, especially but not exclusively in less prosperous areas.

Next: Search for homes in Seattle.