A lot of people assume that all mortgage lenders offer the same rates. After all, interest rates are set by the broader economy, right? Even some lenders tell customers exactly that—“We don’t set the rates, they are what they are.” But that’s not how it actually works.

And now we have the proof. We pulled data from over a thousand lenders nationally to identify the different rates offered for comparable financial scenarios. We then normalized and aggregated this data so that we can identify important “high and low” rate trends time.

What we learned is that the rate you get depends just as much on who you borrow from as when you borrow. Two lenders could quote the exact same borrower radically different rates on the same loan—sometimes differing by hundreds of dollars per month. And in some cases, even the same lender might offer the same borrower totally different rates depending on where that customer came from (e.g., whether you go to their website directly, or click on an advertisement, or visit a third-party website like Nerdwallet or Bankrate).

The difference between a good rate and a bad rate has gotten much worse

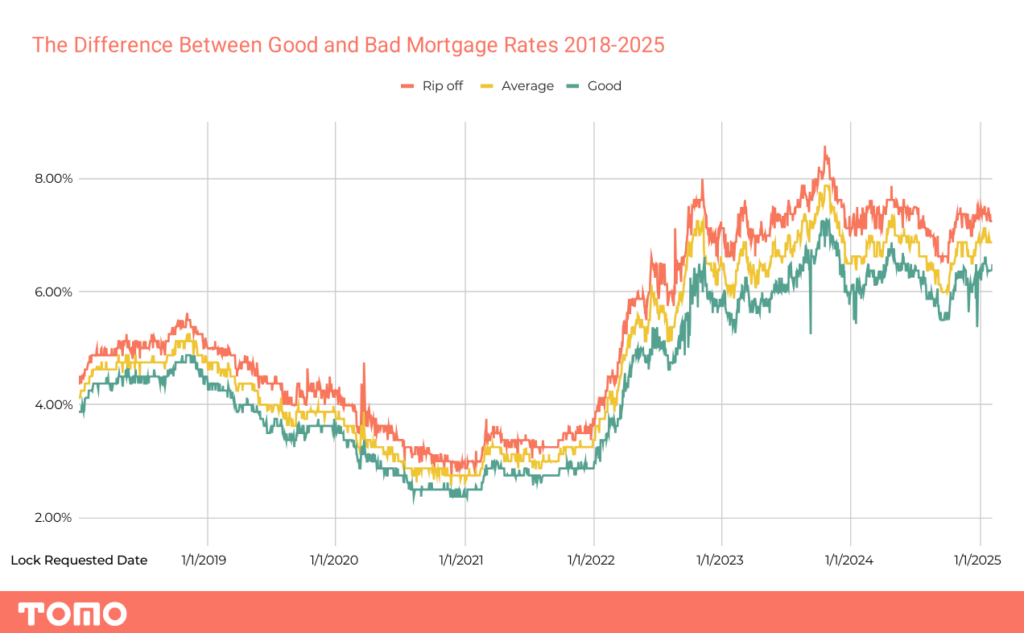

Back in 2018–the difference between a good price and a bad price wasn’t too huge—maybe $80 a month. Annoying, but not life-changing. Today? That gap has ballooned to $287 per month. Same borrower, same house, same loan amount—one just picked the wrong lender and now they’re paying nearly $300 more every single month for no reason.

There are some big-picture economic reasons for this shift, but the impact on homebuyers is the same: more confusion and higher costs. The above graph shows just how wide the spread from a good rate to a rip off rate has grown over the last 8 years.

While a 0.5% interest rate difference in your mortgage rate might not seem like much, over the course of a 30-year loan on a $500,000 home, it adds up—fast. Same house, same homebuyer, same loan. One just shopped around, the other didn’t. The difference? Over $60,000.

And right now, that kind of overpayment is becoming more common.

The real cost of getting an unfair interest rate

Let’s say two buyers with the exact same financial profile are buying a $500,000 home, with one buyer getting a good rate of 6.625% and the other getting a “rip-off” rate of 7.125%. That’s a $164 difference every month—just for choosing the wrong lender.

With a 7.125% rate, your total loan cost (principal + interest) is $1,212,693. With a 6.625% rate, it’s $1,152,560. You’re paying an extra $60K+ at the higher rate—on the exact same home.

That might not sound like much at first, but over time, it adds up.

| Added Cost of an Bad Rate | |

|---|---|

| 1 month | +$164 |

| 5 years | +$12,581 |

| 10 years | +$25,158 |

| 15 years | +$37,301 |

| 30 years | +$60,133 |

What could you do with an extra $60K? A lot, we know, but here are some realistic examples:

- $30,000 toward college tuition—that could be 2-3 years at an in-state public university

- An extra $500 into your 401k every quarter for 30 years—which could grow into nearly $200,000 by retirement

- $18,000 in home upgrades—a kitchen remodel, solar panels, or a backyard overhaul

- A $2,000 vacation every year for 30 years—just from mortgage savings!

How can you can the best interest rate?

We developed some money-saving tips when buying a home, but it’s important to talk to multiple lenders to find the best rate. Even a small percentage difference today can mean a big difference over time.

If you’re ready to start your journey to homeownership, get pre approved with Tomo Mortgage today.