Homeownership isn’t just about having a place to live—it’s one of the best ways to build financial security. As your home’s value grows, it opens doors to new opportunities, creating what we call the Real Estate Wealth-Building Ladder. According to the Census Bureau, about 60% of the average American’s wealth comes from homeownership, making it a critical tool for long-term financial stability.

But in today’s market, with rising home prices and higher interest rates, getting on that ladder can feel impossible for many. The good news? There are actionable ways to save money, even in a challenging market. Here are five practical tips to help you make homeownership a reality—and save thousands in the process.

1. Shop for a rate. But don’t take the online quote at face value

Different lenders can charge the exact same person buying the exact same home radically different interest rates. The difference between a great lender and an overpriced one could be as much as a full percentage point. On a typical $400,000 loan, that’s the difference between paying $2,100 a month or $2,380. Over the life of the loan, that’s tens of thousands of dollars.

But here’s where it gets tricky—the lender with the lowest advertised rate might not be the best deal. Often lenders disguise high rates with added “points” that you can use to pay upfront for a lower interest rate. When rates are high, paying upfront for rate points might not make a lot of sense—it’ll take 5 years or more to break even, typically—and during that time you might want to refinance if rates start to decline. But that doesn’t stop lenders from advertising their rates with 2 or more points that you shouldn’t pay for baked in.

In addition, different lenders can offset the cost of lower rates by tacking on excessive fees—like fees for origination and processing. These are essentially fees for them to give you the loan, even though they already make money on the loan. (At Tomo Mortgage, we don’t charge any of these fees.)

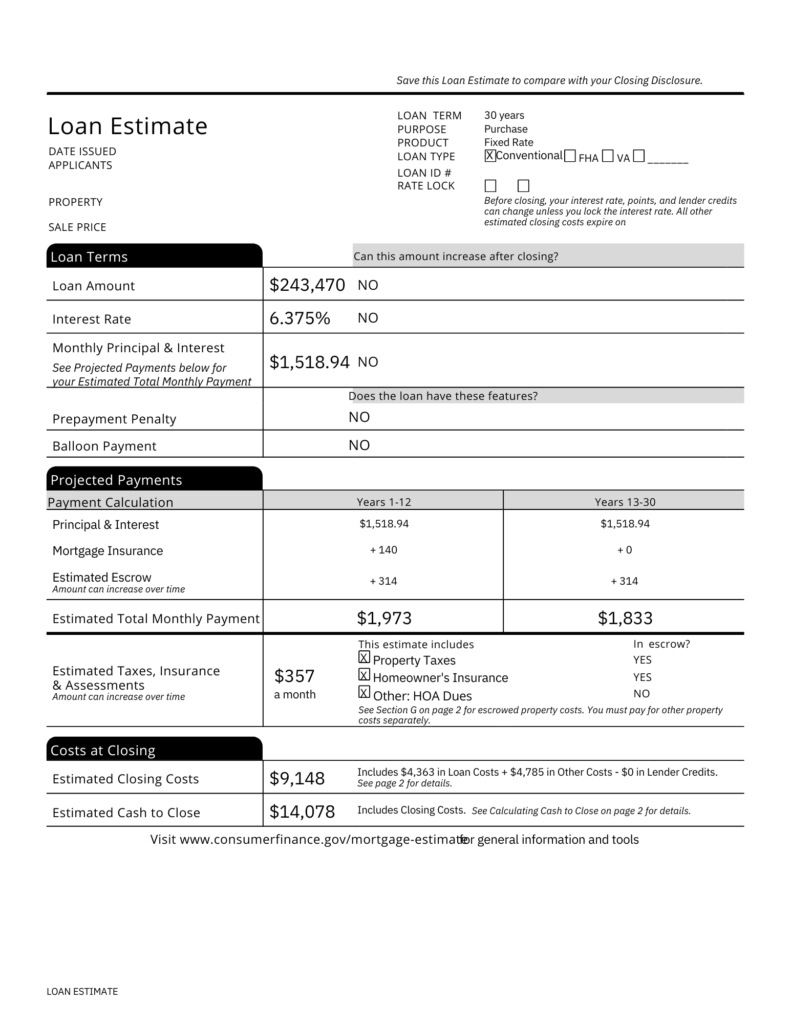

So, how do you figure out who really has the best rate? Ask every lender for a CFPB Loan Estimate—a document that breaks down all the costs of the loan. This step is key because lenders are legally required to disclose everything, including hidden fees that might not show up in their initial quotes. Comparing these side by side can save you serious money.

2. Know your DTI & credit thresholds

Your credit score is one of the biggest factors in determining your mortgage rate. Improving your score even a little can save you big, especially when it goes from one “category of credit” into another (it’s simply how rates get calculated). For example, if your score is 680, paying off a credit card to bump it up to 700 could put you in a better rate tier and can be as simple as paying off one credit card. The same goes for your Debt-to-Income (DTI) ratio—lowering it can make you a more attractive borrower and help you qualify for better terms.

Most lenders won’t go out of their way to help you improve your credit, but it’s worth asking. At Tomo, we train Loan Officers to help buyers boost their credit before locking in a loan, because a few small moves can mean big savings for our clients.

3. Play the address

Where you buy—and your household income—can unlock significant savings through programs like the Community Reinvestment Act (CRA) and Special Purpose Credit Programs (SPCPs). These programs are designed to help homebuyers who earn below 80% of the Area Median Income (AMI) or who are purchasing in certain census tracts.

Banks get incentives to lend to buyers in these categories, which can reduce your interest rate by as much as half a percentage point. Over a 30-year loan, that can save you tens of thousands of dollars.

Unfortunately, most lenders keep the extra incentives for themselves, but at Tomo, we believe those savings should go back to the buyer. If your household income or the property you’re buying qualifies, you could score a much better rate than you’d find elsewhere.

Curious if you qualify? Use tools like the AMI Lookup Tool to see if your income or the area you’re buying in falls within the eligible range.

By focusing on these programs, you’re not just saving money—you’re tapping into incentives designed to make homeownership more accessible.

4. Don’t forget about insurance costs

Back in the 90s, home insurance was practically an afterthought—around $30 a month for most buyers. Those days are long gone. Extreme weather, from hurricanes to wildfires, has caused insurance costs to skyrocket. Today, the national average is about $160 a month.

But here’s the kicker: if you’re buying in a high-climate risk area, like a coastal town or a wildfire-prone zone in California, insurance can easily cost you over $1,000 a month. That’s not a small jump—it’s a massive hit to your monthly budget, and one that can catch buyers off guard.

This is why it’s critical to factor insurance costs into your overall homebuying plan. Don’t just focus on the mortgage payment—dig into insurance quotes for the specific area you’re looking to buy in. Rates can vary significantly based on location and provider, so shopping around is a must.

5. Buy now, refinance later

If you’re waiting for interest rates to drop before buying a home, here’s the reality: rates aren’t expected to fall anytime soon. And waiting can cost you more in the long run. While you’re on the sidelines, home prices and rents keep climbing, and you’re missing out on the chance to build equity.

Here’s a smarter approach: lock in a fixed-rate loan now and refinance if rates drop in the future. Even if today’s rates aren’t ideal, buying sooner lets you start building equity and get ahead of rising prices. Housing inventory is tight—86% of homeowners have rates in the 5’s or lower, so they’re staying put, which means prices aren’t going to fall anytime soon.

Leave with this

Homeownership isn’t just a pipe dream—it’s one of the best ways to build wealth and stability. But today’s market is tough, and it can feel impossible at times. That’s why it’s more important than ever to know how to save.

By shopping for the best rate, improving your credit, taking advantage of income-based programs, planning for insurance costs, and buying strategically, you can save thousands and set yourself up for success.

If you’re ready to start your journey to homeownership, get pre approved with Tomo Mortgage today.