Today’s mortgage rates aren’t extreme, but they feel that way to homebuyers, prolonging searches and increasing stress.

The real cost of homeownership has been growing significantly in recent years.1 In 2000, a typical homebuyer spent 20% of their income on a mortgage. Today, roughly 38% of a buyer’s income goes toward housing.

Every day, we talk to homebuyers who are struggling, making tradeoffs. Buying a home was once a joyful and empowering experience, but now it’s consumed by stress. Tomo believes the joy of owning a home should never be overshadowed by the hassle of buying one, so we set out to understand the nature of homebuyer stress in 2025.

In August 2025, we surveyed more than 1,000 homebuyers—people actively searching for a new home, or those who purchased a new home in the last 60 days. We asked them a series of questions about their experiences in the housing market and their feelings about home buying.

We found that homebuyers perceive mortgage rates as unusually high and describe them as one of America’s biggest economic problems. They believe this, even though today’s interest rates are below the 50-year average. Because home prices have increased so much, even small fluctuations in rates have a significant influence on lifestyle and financial stability. Interest rates mark the line between affordability and years of financial stress.

Despite their commitment and ability to buy, active homebuyers are distraught by the costs and sacrifices required to own a home in 2025. And, more often than not, this experience is made much worse due to the complexity and outright deception in the mortgage-buying process.

High housing costs are putting life on hold

The emotional and financial toll of buying a home in today’s economy is significant. One in three homebuyers (35%) say the housing market is “making me rethink my entire life,” and 42% believe buying a home is “incredibly risky.” Such financial anxiety is pervasive: 60% of buyers expect to feel “house poor” once they close on a home.

Sacrifice has always been part of the homebuying journey, a fact 92% of buyers acknowledge, as they make concessions on the size and location of homes they pursue. Homebuyers also make tough trade-offs in their budgets: 88% plan to cut back on spending and saving, with 46% skipping vacations, 23% cutting into emergency savings, and 23% cutting into retirement savings.

Still, the nature of the sacrifices seems to have intensified. For a majority of buyers (59%), high costs are reshaping their lives, forcing them to delay or abandon milestones like marriage, children, education, or career changes.

What homebuyers are giving up to own a home

Anxious shoppers are pessimistic about rates, waiting on the sidelines

Mortgage rates are central to homebuyer frustrations, with nearly all buyers (85%) having postponed their search for some period of time while waiting for rates to come down. One in three buyers believe current rates are the biggest economic problem in America.

Our data confirms a frozen market, where many buyers describe themselves as “actively searching” for a home, while also saying they are waiting for mortgage interest rates to come down before they buy. Buyers feel caught between two substantial forces, their need for a new home and the extraordinary cost to get one.

Inaction among homebuyers is compounded by widespread pessimism about the future of mortgage interest rates: 82% believe rates will stay the same or increase in the next six months. This is in contrast to forecasts from Fannie Mae, Wells Fargo, and the Mortgage Bankers Association, all projecting rate declines in the next two quarters.2 Despite much attention paid to President Trump’s displeasure with the Federal Reserve and its chairman, Jerome Powell, including calls for Powell’s resignation3 and other threats4, very few homebuyers (20%) expect the Trump Administration to bring down rates.

Most buyers misunderstand mortgage rate history

At least some market stagnation can be traced to a common misunderstanding of historic mortgage interest rates. This misunderstanding has been amplified by persistent negative messaging from politicians and media, not to mention recency bias attached to pandemic-era rates that were the lowest in history.5

While today’s rates are much higher than during the pandemic, they are also approximately one percentage point lower than the 50-year average (7.7%, according to Freddie Mac). Record-low rates of the last decade were an exception, not the norm. Still, many buyers remain stuck in the belief that rates should be lower.

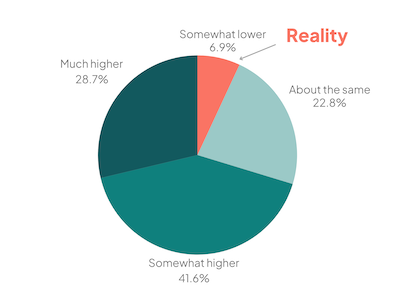

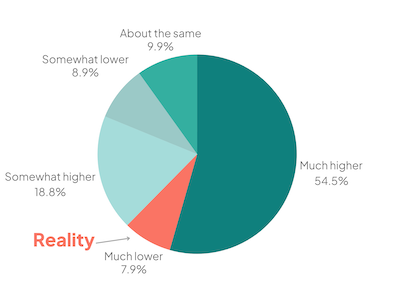

Our data further clarifies this perception gap. Seventy-five percent of homebuyers think today’s rates are abnormally high: 55% think rates are much higher today than in the 1980s, when they were nearly three times higher, and 70% think rates are higher now than they were last year, when in fact they are the same or slightly lower.

How do today’s rates compare to last year?

How do today’s rates compare to the 1980s?

Most homebuyers are misled about how to shop for a mortgage

Another critical problem is that many homebuyers lack clear, honest guidance as they navigate a mortgage-buying process that is often rigged to make them pay more than necessary.

As part of our survey, we showed people standard interest rate information—numbers they are likely to see on a wide range of mortgage lenders’ websites. We then asked them a series of questions to better understand what they believed to be true, based on these numbers.

The biggest problem was points. A majority of homebuyers (68%) do not understand what mortgage points are, believing them to reflect the total closing costs or fees associated with processing and origination (those fees aren’t reflected at all in this scenario). One in three homebuyers (31%) think points are required fees.

When asked about the advertised rates homebuyers see on lender websites, more than half (53%) said they believe those rates reflect what a typical buyer will get, when in fact those rates reflect only what an ideal buyer would be offered (i.e., ideal credit, high down payment). Additionally, 60% of homebuyers are unaware that they can negotiate with lenders to be shown more competitive rates.

The only way to accurately compare lenders, apples-to-apples, is through an official “loan estimate,” with transparency requirements set by the CFPB. Yet most buyers (58%) only get an official loan estimate from only one or two lenders. Instead, homebuyers use unofficial quotes or estimates shown online, often during the pre-approval phase, at which point there’s no formal rate the lender can offer.

Our data also reveals alarming trends in how little time buyers spend shopping for a mortgage. More than half (52%) of homebuyers spend less than three hours selecting a lender, and one in five spend less than an hour. Additionally, 59% admit they have spent more time researching a small purchase like clothes, beauty products, or hotels than choosing a lender. One in five say they have spent more time choosing something to watch on TV than picking a mortgage lender.

Collectively, mortgage shopping confusion will cost Americans $11 billion in 2025.

What homebuyers should do when shopping for a mortgage

-

1Shop for the best rate. Get official loan estimates from at least three lenders after you have an accepted offer on a new home. Don’t feel obligated to stick with the lender that gave you a preapproval, or rely on your real estate agent to direct you to a single lender they prefer.

-

2Benchmark what’s fair for your profile. Use tools like TrueRate to see the spread between fair pricing and a rip-off.

-

3Know what you’re paying for. Don’t take “point fees” at face value, and scrutinize common but unnecessary fees for “origination” or “processing,” or something vague like a “tech fee.” Look at Section A of a loan estimate to understand the real fees a lender is charging, so that you can compare them apples to apples. Ask lenders for a rate with no point fees included (i.e., their “par rate”), so that it’s easier to compare rates across lenders. .

These steps won’t solve affordability challenges overnight, but they can help significantly reduce monthly mortgage payments. Reducing unnecessary costs and empowering buyers to make better decisions is a major step toward alleviating the stress homebuyers are feeling today.

Survey Methodology

The findings in this report are based on a survey conducted online using the UserTesting market research platform. Panel participants must pass a manually reviewed practice test, blinded screeners, and automated fraud-detection solutions to ensure high accuracy of responses.

Sources:

1. Harvard University. Joint Centers for Housing Studies. Home Price to Income Ratio Reaches Record High. Jan 2024.

2. U.S. News Mortgage Rate Forecast, Sep 2025.

3. NPR. Trump calls for Fed Chari Jerome Powell’s ‘termination’ in blistering attack. Apr 2025.

4. CNBC. Trump threatens Fed chair Powell with ‘major lawsuit,’ demands interest rate cut. Aug 2025.

5. Federal Reserve Bank of Saint Louis. 30-year Fixed Rate Mortgage Average in the United States. Sep 2025.