Get your TrueRate for California

Histogram showing 3 data points from 5.87% to 6.55%. Use Tab to navigate between segments, and Enter to select a bar.

found 72 lenders for you—rates updated Mar 8, 2026

Rates updated Mar 8, 2026

See lenders that match your loan details (assuming a 30-year fixed, conventional loan)

Insights

Negotiate everything—rates, fees, and terms are not set in stone.

TrueRate’s low rate range

Lenders in CA likely to have low rates

TrueRate’s list is based on real rates given to home buyers over the last three years.

| Lender | Lender fees | Customer reviewsMore information | |

|---|---|---|---|

| No lender feesHighly rated | Highly rated | |

| $0-$1095Highly rated | Highly rated | |

| $995Mixed reviews | Mixed reviews | |

| $995Average | Average |

TrueRate’s high rate range

Lenders in CA likely to have high rates

These TrueRate lenders historically gave customers rates that are higher than average. Don't let this happen to you.

| Lender | Lender fees | Customer reviewsMore information | |

|---|---|---|---|

| $1790Above average | Above average | |

| $1740Limited reviews | Limited reviews | |

| $1565Mixed reviews | Mixed reviews | |

| $1490Mixed | Mixed |

TrueRate’s average rate range

Lenders in CA likely to have average rates

You deserve better than what these 64 lenders historically provide.

- 1st Security Bank of Washington

- American Neighborhood Mortgage

- American Pacific Mortgage Corp

- Benchmark Mortgage

- Bank of England

- CalCon Mutual Mortgage LLC

- CMG Mortgage Inc.

- Coastal Funding SLC, Inc.

- CrossCountry Mortgage, LLC

- DAS Acquisition Company, LLC

- Digital Federal Credit Union

- Envoy Mortgage, Ltd.

- Evergreen Moneysource Mortgage

- Evolve Bank & Trust

- Fairway Independent Mortgage Corp

- FBC Mortgage, LLC

- First Community Mortgage

- Franklin Loan Center

- Gold Star Mortgage Financial Group

- Golden 1 Credit Union

- Golden Empire Mortgage, Inc.

- Guaranteed Rate Affinity, LLC

- Guaranteed Rate, Inc.

- Homeowners Financial Group, LLC

- Homeside Financial, LLC

- HomeStreet Bank

- Huntington National Bank

- Intercap Lending Inc.

- Ixonia Bank

- JMJ Financial Group Inc.

- Kinecta Federal Credit Union

- Ladera Lending, Inc.

- LeaderOne Financial Corp.

- LoanSimple

- Logix Federal Credit Union

- Mason-McDuffie Mortgage Corporation

- Mortgage Capital Partners, Inc.

- Mortgage Management Consultants

- Mutual of Omaha Mortgage

- Nations Lending Corporation

- NFM, Inc

- Northpointe Bank

- On Q Financial, Inc.

- Pacific Residential Mortgage

- Planet Home Lending, LLC

- Premier Mortgage Resources, LLC

- Presidential Bank, FSB

- PrimeLending

- Residential Wholesale Mortgage

- Scenic Oaks Funding, Inc.

- SnapFi, Inc.

- Success Mortgage Partners, Inc

- Summit Funding, Inc

- Summit Mortgage Corporation

- SWBC Mortgage Corporation

- Synergy One Lending

- The Federal Savings Bank

- TJC Mortgage Inc

- Tri Counties Bank

- University Credit Union

- V.I.P. Mortgage, Inc.

- Van Dyk Mortgage Corporation

- Watermark Capital, Inc.

- Waterstone Mortgage Corporation

Don’t let lenders pull a fast one on you

Learn how really low rates often come with hidden fees. Drag the slider to see how rates and fees are connected.

Insights

TrueRate report

Buying a home shouldn’t feel impossible—see what’s driving buyer stress in 2025.

What is TrueRate by Tomo Mortgage?

TrueRate is a tool for homebuyers, created by Tomo Mortgage. It uses AI and analytical models to show you what a fair mortgage rate really looks like—your “true rate”—based on your unique financial situation and real market conditions. It strips out all the bait-and-switch pricing you see all over the internet, such as rates advertised with big point fees hiding in the fine print.

Instead of giving you a one-size-fits-all estimate, TrueRate calculates what rate you should be looking for that day, using the same kinds of data that lenders themselves rely on to provide their own rate information. We’re just making it all public for the first time. You’ll be able to see whether an interest rate offered by a bank, credit union, or mortgage company is low, average, or too high—before you agree to anything.

Frequently asked questions

Tomo Mortgage created TrueRate because it's really hard to get an honest answer to a simple question—what's a good rate for me right now, and where can I get it? Even big mortgage companies struggle to figure out whether their interest rates are better or worse than another lender on any given day. But not having a clear and simple answer to “what's a good rate for me” costs homebuyers in the U.S. a lot of money—roughly $11 billion in 2025 alone.

We created TrueRate to make it easier for people to find lenders with low interest rates for their specific situation. Tomo Mortgage has lower rates a lot of the time, but we're not always the best pick for everyone 100% of the time. No lender is. But, when people have more information they can make better decisions, save money, and everyone wins.

TrueRate uses a mix of public and private data to estimate what rates lenders are actually offering to people like you. Rather than other websites that use lenders' advertised interest rates, we use real loan data (about a million loans, and we're adding tens of thousands every day). It focuses on one of the most common types of mortgage: 30-year, fixed-rate conventional loans for primary residences.

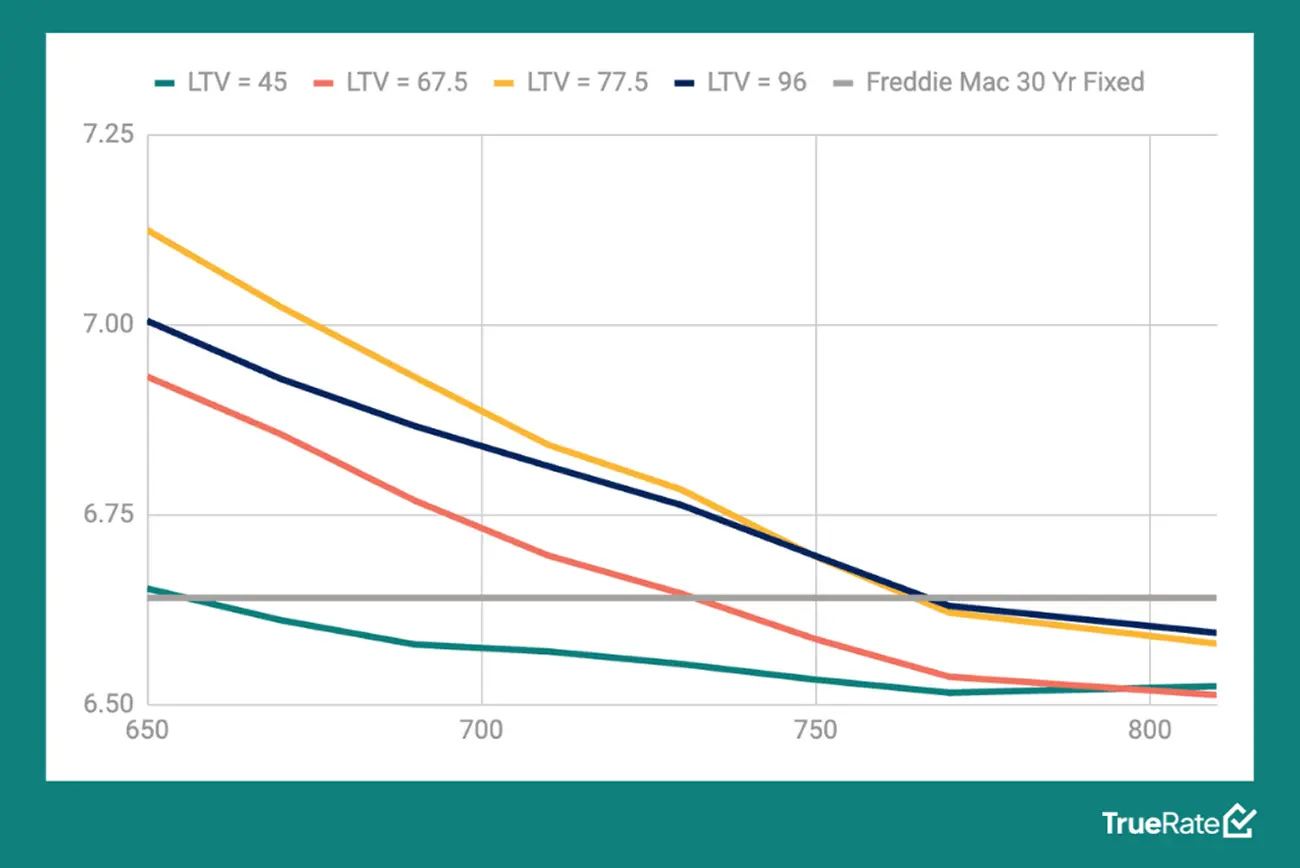

To answer this accurately, we take into account:

- Your credit score

- Your home price and down payment (so that we know the loan-to-value ratio)

- Your location (city and state)

- Discount points (we normalize our data to account for “par rate,” that is, a rate with zero added point fees and very close to the APR)

With all this data, we're able to see what other lenders are charging people in the same situation. We break down these rates into three categories:

- Good rate = better than 70% of lenders (top 30th percentile)

- Average rate = middle-of-the-road (50th percentile)

- Bad rate = higher than most people pay (bottom 70th percentile)

This way, you can see how your quote stacks up against the market.

Unlike other mortgage comparison tools, TrueRate doesn't use advertised rates provided by a small subset of lenders. Instead, TrueRate is a model that factors a wide range of lenders—over one thousand of them across the U.S. This includes big, independent mortgage companies, major banks, and small nonprofit credit unions. The model is trained on real loan data, pulled from both public records (like government mortgage databases) and private and proprietary sources (special datasets that include pricing and borrower traits).

We've tested and validated our model in two key ways.

- Benchmark tracking. Does our model yield similar results to 3rd party benchmarks?

- Control effectiveness. When we say we're controlling for variables in the loan scenario, does the model sufficiently capture the nuances of how each variable impacts market rate?

Here's how our model performed.

No, not exactly. TrueRate is designed to show you what's typical based on recent trends. Because we don't work directly with any specific lender (apart from ourselves), we can't promise a lender will give you that exact rate shown on the platform.

Think of TrueRate like a really smart compass—it shows you the direction and gives you a solid baseline to compare against, even though individual lender offers may still vary a bit. More important, the more data you have going into a conversation with a lender, the more confident you can be when negotiating an interest rate.

Here's what you get when you use TrueRate:

- A clear, customized look at the rate you should expect

- Confidence when comparing lenders or negotiating an offer

- A fair, apples-to-apples way to shop for a mortgage

- Zero gimmicks—just data-backed results

TrueRate won't magically get you the lowest rate on Earth. But it will tell you, honestly, whether the rate you're being offered is fair—and that's one of the smartest moves you can make when buying a home.

Let’s talk about buying a house in California

Buying a home in California is no easy task. High mortgage rates are tough enough—but when paired with California’s extremely high home prices, buying a home is even harder.

Let’s start with mortgage rates. After peaking in recent years, rates are finally starting to come down in 2024 and 2025. That’s welcome news for buyers hoping to avoid locking in a 30-year fixed mortgage in the 7% range. But in California, where home prices are some of the highest in the country, even a small change in interest rates can have a big impact on affordability. That’s why it’s more important than ever to shop around for the best possible rate.

In major areas like San Francisco, Los Angeles, and Silicon Valley, median home prices are easily in the million-dollar range. Cities like San Diego and Orange County aren’t far behind.

Still, California remains highly desirable. With its sunny weather, booming tech industry, and diverse lifestyle offerings, the state continues to attract buyers. Demand remains strong, particularly in tech-driven regions, and a limited housing supply means that prices haven’t dropped as much as some buyers may have hoped—even as rates have started to ease.

There are, however, programs that can help. First-time homebuyers and those who qualify for FHA loans may benefit from lower down payment requirements and reduced mortgage insurance costs, making homeownership a bit more accessible.

So, what does the 2024 California housing market look like? It’s defined by high interest rates, steep home prices, and strong demand—but also by opportunity for those who are prepared. Finding a good deal often takes patience, persistence, and sometimes a willingness to consider a fixer-upper in exchange for a shot at the California dream.