Get your TrueRate for Colorado

Histogram showing 3 data points from 5.93% to 6.58%. Use Tab to navigate between segments, and Enter to select a bar.

found 72 lenders for you—rates updated Mar 12, 2026

Rates updated Mar 12, 2026

See lenders that match your loan details (assuming a 30-year fixed, conventional loan)

Insights

Negotiate everything—rates, fees, and terms are not set in stone.

TrueRate’s low rate range

Lenders in CO likely to have low rates

TrueRate’s list is based on real rates given to home buyers over the last three years.

| Lender | Lender fees | Customer reviewsMore information | |

|---|---|---|---|

| No lender feesHighly rated | Highly rated | |

| $0-$1145Limited reviews | Limited reviews | |

| $600Below average | Below average | |

| $850Below average | Below average | |

| $995Mixed reviews | Mixed reviews | |

| $995Average | Average |

TrueRate’s high rate range

Lenders in CO likely to have high rates

These TrueRate lenders historically gave customers rates that are higher than average. Don't let this happen to you.

| Lender | Lender fees | Customer reviewsMore information | |

|---|---|---|---|

| $1565Mixed reviews | Mixed reviews |

TrueRate’s average rate range

Lenders in CO likely to have average rates

You deserve better than what these 65 lenders historically provide.

- Alerus Financial NA

- Alpine Bank

- American Financing Corporation

- American Pacific Mortgage Corp

- Benchmark Mortgage

- Arvest Bank

- Bank of Colorado

- Bank of England

- Bell Bank

- BOK Financial (BOKF, NA)

- CalCon Mutual Mortgage LLC

- CMG Mortgage Inc.

- Commerce Bank

- Compass Mortgage, Inc.

- CrossCountry Mortgage, LLC

- DAS Acquisition Company, LLC

- Diamond Residential Mortgage Corp

- Digital Federal Credit Union

- Elevation Credit Union

- Fairway Independent Mortgage Corp

- FBC Mortgage, LLC

- First International Bank & Trust

- First Interstate Bank

- First National Bank of Omaha

- First United Bank and Trust Company

- Franklin Loan Center

- Gateway First Bank

- Gold Star Mortgage Financial Group

- Guaranteed Rate Affinity, LLC

- Guaranteed Rate, Inc.

- Highlands Residential Mortgage

- Homeside Financial, LLC

- Homestead Funding Corp.

- Huntington National Bank

- Intercap Lending Inc.

- Ixonia Bank

- LeaderOne Financial Corp.

- LoanSimple

- LoanPeople LLC

- Mason-McDuffie Mortgage Corporation

- Mortgage300 Corporation

- Mutual of Omaha Mortgage

- Nations Lending Corporation

- Nations Reliable Lending LLC

- NBH Bank

- NFM, Inc

- Northpointe Bank

- On Q Financial, Inc.

- Planet Home Lending, LLC

- PrimeLending

- Princeton Mortgage Corporation

- Priority Home Mortgage, L.P.

- Proper Rate, LLC

- Residential Wholesale Mortgage

- Success Mortgage Partners, Inc

- Summit Funding, Inc

- Summit Mortgage Corporation

- Sunflower Bank, N.A.

- SWBC Mortgage Corporation

- Synergy One Lending

- The Federal Savings Bank

- V.I.P. Mortgage, Inc.

- Van Dyk Mortgage Corporation

- Watermark Capital, Inc.

- Waterstone Mortgage Corporation

Don’t let lenders pull a fast one on you

Learn how really low rates often come with hidden fees. Drag the slider to see how rates and fees are connected.

Insights

TrueRate report

Buying a home shouldn’t feel impossible—see what’s driving buyer stress in 2025.

What is TrueRate by Tomo Mortgage?

TrueRate is a tool for homebuyers, created by Tomo Mortgage. It uses AI and analytical models to show you what a fair mortgage rate really looks like—your “true rate”—based on your unique financial situation and real market conditions. It strips out all the bait-and-switch pricing you see all over the internet, such as rates advertised with big point fees hiding in the fine print.

Instead of giving you a one-size-fits-all estimate, TrueRate calculates what rate you should be looking for that day, using the same kinds of data that lenders themselves rely on to provide their own rate information. We’re just making it all public for the first time. You’ll be able to see whether an interest rate offered by a bank, credit union, or mortgage company is low, average, or too high—before you agree to anything.

Frequently asked questions

Tomo Mortgage created TrueRate because it's really hard to get an honest answer to a simple question—what's a good rate for me right now, and where can I get it? Even big mortgage companies struggle to figure out whether their interest rates are better or worse than another lender on any given day. But not having a clear and simple answer to “what's a good rate for me” costs homebuyers in the U.S. a lot of money—roughly $11 billion in 2025 alone.

We created TrueRate to make it easier for people to find lenders with low interest rates for their specific situation. Tomo Mortgage has lower rates a lot of the time, but we're not always the best pick for everyone 100% of the time. No lender is. But, when people have more information they can make better decisions, save money, and everyone wins.

TrueRate uses a mix of public and private data to estimate what rates lenders are actually offering to people like you. Rather than other websites that use lenders' advertised interest rates, we use real loan data (about a million loans, and we're adding tens of thousands every day). It focuses on one of the most common types of mortgage: 30-year, fixed-rate conventional loans for primary residences.

To answer this accurately, we take into account:

- Your credit score

- Your home price and down payment (so that we know the loan-to-value ratio)

- Your location (city and state)

- Discount points (we normalize our data to account for “par rate,” that is, a rate with zero added point fees and very close to the APR)

With all this data, we're able to see what other lenders are charging people in the same situation. We break down these rates into three categories:

- Good rate = better than 70% of lenders (top 30th percentile)

- Average rate = middle-of-the-road (50th percentile)

- Bad rate = higher than most people pay (bottom 70th percentile)

This way, you can see how your quote stacks up against the market.

Unlike other mortgage comparison tools, TrueRate doesn't use advertised rates provided by a small subset of lenders. Instead, TrueRate is a model that factors a wide range of lenders—over one thousand of them across the U.S. This includes big, independent mortgage companies, major banks, and small nonprofit credit unions. The model is trained on real loan data, pulled from both public records (like government mortgage databases) and private and proprietary sources (special datasets that include pricing and borrower traits).

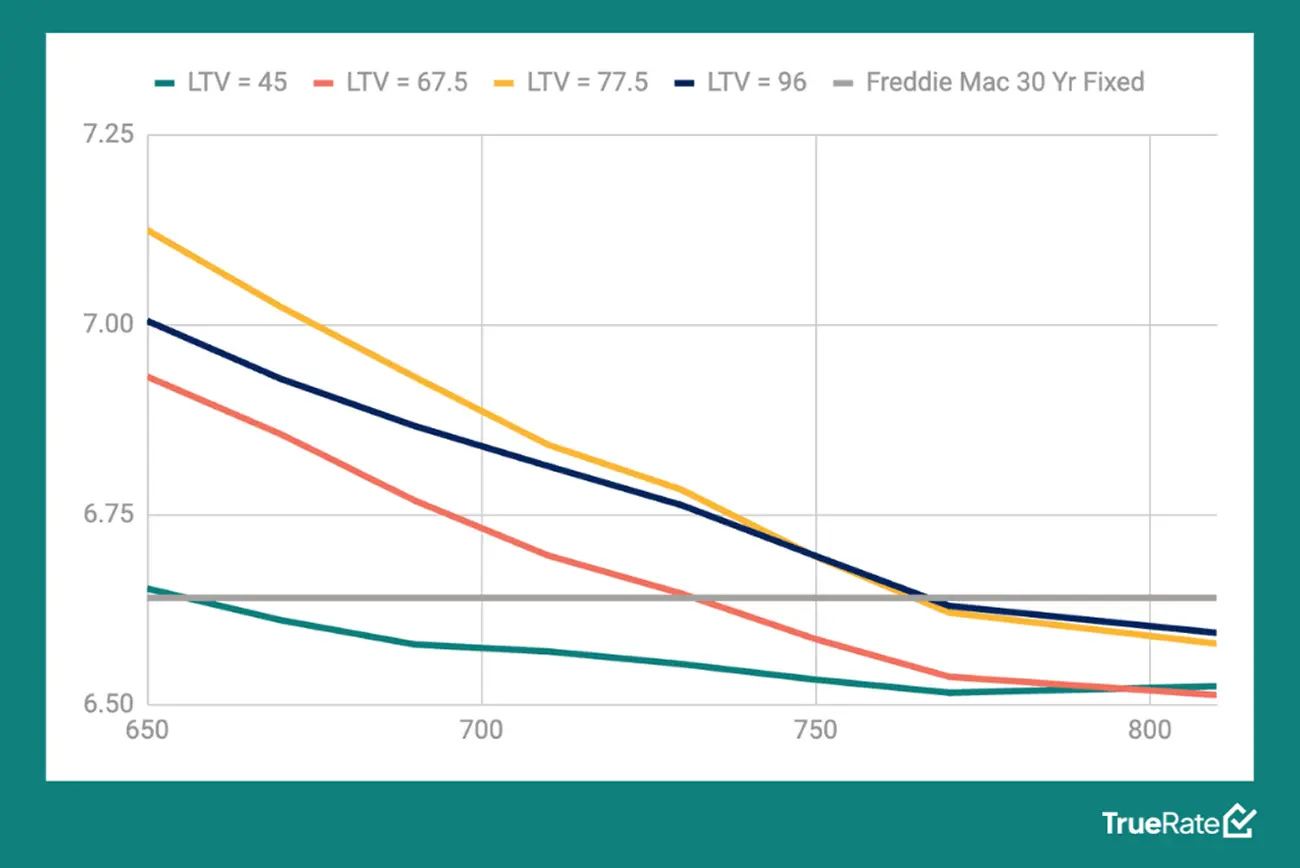

We've tested and validated our model in two key ways.

- Benchmark tracking. Does our model yield similar results to 3rd party benchmarks?

- Control effectiveness. When we say we're controlling for variables in the loan scenario, does the model sufficiently capture the nuances of how each variable impacts market rate?

Here's how our model performed.

No, not exactly. TrueRate is designed to show you what's typical based on recent trends. Because we don't work directly with any specific lender (apart from ourselves), we can't promise a lender will give you that exact rate shown on the platform.

Think of TrueRate like a really smart compass—it shows you the direction and gives you a solid baseline to compare against, even though individual lender offers may still vary a bit. More important, the more data you have going into a conversation with a lender, the more confident you can be when negotiating an interest rate.

Here's what you get when you use TrueRate:

- A clear, customized look at the rate you should expect

- Confidence when comparing lenders or negotiating an offer

- A fair, apples-to-apples way to shop for a mortgage

- Zero gimmicks—just data-backed results

TrueRate won't magically get you the lowest rate on Earth. But it will tell you, honestly, whether the rate you're being offered is fair—and that's one of the smartest moves you can make when buying a home.

In Colorado, the housing market offers a mix of excitement and opportunity

Interest rates have continued to decline throughout 2024 and are expected to improve even further in 2025. For anyone who has been waiting for the right time to buy a home, the outlook is becoming increasingly favorable. Lower interest rates mean more affordable monthly mortgage payments, bringing homeownership in the Centennial State within reach for many buyers.

Colorado offers a variety of housing options, depending on your lifestyle and budget. Cities like Denver and Boulder are known for their beautiful scenery, vibrant tech scene, and active outdoor culture. However, these popular areas tend to come with higher price tags and more competition. For those willing to look beyond the big cities, communities such as Colorado Springs, Fort Collins, and other smaller towns still offer access to stunning mountain views—along with more space and greater affordability.

First-time homebuyers in Colorado also have access to several helpful programs designed to ease the path to ownership. These may include down payment assistance and more favorable loan terms, making it possible to buy even in a competitive market.

One of Colorado’s biggest draws is its incredible natural beauty. Whether you’re into hiking, skiing, or simply enjoying the scenic mountain views, the state’s outdoor lifestyle is hard to match. With falling interest rates and thoughtful planning, now could be the perfect time to make your move and start building a life in this breathtaking part of the country.