Get your TrueRate for Texas

Histogram showing 3 data points from 5.68% to 6.43%. Use Tab to navigate between segments, and Enter to select a bar.

found 120 lenders for you—rates updated Feb 20, 2026

Rates updated Feb 20, 2026

See lenders that match your loan details (assuming a 30-year fixed, conventional loan)

Insights

Negotiate everything—rates, fees, and terms are not set in stone.

George RobinsonTrueRate Data Scientist

George RobinsonTrueRate Data ScientistTrueRate’s low rate range

Lenders in TX likely to have low rates

TrueRate’s list is based on real rates given to home buyers over the last three years.

TrueRate’s high rate range

Lenders in TX likely to have high rates

These TrueRate lenders historically gave customers rates that are higher than average. Don't let this happen to you.

| Lender | Lender fees | ||

|---|---|---|---|

| $1899Mixed reviews | Mixed reviews | |

| $1890Mixed reviews | Mixed reviews | |

| $1740Limited reviews | Limited reviews | |

| $1565Mixed reviews | Mixed reviews | |

| $1500Mixed reviews | Mixed reviews | |

| $1490Mixed | Mixed | |

TrueRate’s average rate range

Lenders in TX likely to have average rates

You deserve better than what these 106 lenders historically provide.

- Alerus Financial NA

- Altra Federal Credit Union

- Amarillo National Bank

- American Financing Corporation

- American Neighborhood Mortgage

- American Pacific Mortgage Corp

- American Portfolio Mortgage Corporation

- Benchmark Mortgage

- Arvest Bank

- Associated Mortgage Corporation

- Assurance Financial Group, L.L.C.

- Atlantic Bay Mortgage Group

- Bank of England

- Bayshore Mortgage Funding

- Belem Servicing, LLC DBA Patriot

- Bell Bank

- BOK Financial (BOKF, NA)

- CalCon Mutual Mortgage LLC

- Capital Bank, N.A.

- City Bank

- Cliffco, Inc

- CMG Mortgage Inc.

- Compass Mortgage, Inc.

- CrossCountry Mortgage, LLC

- DAS Acquisition Company, LLC

- Diamond Residential Mortgage Corp

- Digital Federal Credit Union

- Direct Mortgage Loans

- DSLD Mortgage LLC

- Eagle Bank and Trust Company

- East Coast Capital

- EECU

- Encompass Lending Group, L.P.

- Endeavor Capital LLC

- Envoy Mortgage, Ltd.

- Evergreen Moneysource Mortgage

- Evolve Bank & Trust

- Fairway Independent Mortgage Corp

- FBC Mortgage, LLC

- Fidelity Bank

- First Community Mortgage

- First Financial Bank

- First National Bank of Omaha

- First United Bank and Trust Company

- Franklin Loan Center

- Gateway First Bank

- GMFS, LLC

- Gold Star Mortgage Financial Group

- Golden Empire Mortgage, Inc.

- Goldwater Bank National Association

- Guaranteed Rate Affinity, LLC

- Guaranteed Rate, Inc.

- Highlands Residential Mortgage

- Homeowners Financial Group, LLC

- Homeside Financial, LLC

- Homestead Funding Corp.

- HomeTrust Mortgage Company

- Huntington National Bank

- Integrity Home Mortgage Corporation

- Intercap Lending Inc.

- Intercoastal Mortgage, LLC

- InterLinc Mortgage

- Ixonia Bank

- JMJ Financial Group Inc.

- Ladera Lending, Inc.

- LeaderOne Financial Corp.

- LoanSimple

- LoanPeople LLC

- Mason-McDuffie Mortgage Corporation

- Mutual of Omaha Mortgage

- Nations Lending Corporation

- Nations Reliable Lending LLC

- NBH Bank

- NFM, Inc

- Northpointe Bank

- On Q Financial, Inc.

- Pacific Residential Mortgage

- Planet Home Lending, LLC

- Premier Mortgage Resources, LLC

- PrimeLending

- PrimeLending Ventures LLC

- Princeton Mortgage Corporation

- Priority Home Mortgage, L.P.

- Republic State Mortgage Co.

- Residential Wholesale Mortgage

- SeaTrust Mortgage Company

- Smart Choice Mortgage, LLC

- Success Mortgage Partners, Inc

- Summit Funding, Inc

- Sunflower Bank, N.A.

- Susser Bank

- SWBC Mortgage Corporation

- Synergy One Lending

- Texas Tech Federal Credit Union

- The Federal Savings Bank

- The Mortgage Link, Inc.

- TJC Mortgage Inc

- Town Square Mortgage & Investments

- TowneBank

- United Northern Mortgage Bankers

- V.I.P. Mortgage, Inc.

- Van Dyk Mortgage Corporation

- Victorian Finance, LLC

- Watermark Capital, Inc.

- Waterstone Mortgage Corporation

- Willow Bend Mortgage

Don’t let lenders pull a fast one on you

Learn how really low rates often come with hidden fees. Drag the slider to see how rates and fees are connected.

Insights

Insights by James McTernanTomo Mortgage Loan Advisor - NMLS #1112719

Insights by James McTernanTomo Mortgage Loan Advisor - NMLS #1112719TrueRate report

Buying a home shouldn’t feel impossible—see what’s driving buyer stress in 2025.

What is TrueRate by Tomo Mortgage?

TrueRate is a tool for homebuyers, created by Tomo Mortgage. It uses AI and analytical models to show you what a fair mortgage rate really looks like—your “true rate”—based on your unique financial situation and real market conditions. It strips out all the bait-and-switch pricing you see all over the internet, such as rates advertised with big point fees hiding in the fine print.

Instead of giving you a one-size-fits-all estimate, TrueRate calculates what rate you should be looking for that day, using the same kinds of data that lenders themselves rely on to provide their own rate information. We’re just making it all public for the first time. You’ll be able to see whether an interest rate offered by a bank, credit union, or mortgage company is low, average, or too high—before you agree to anything.

Frequently asked questions

Tomo Mortgage created TrueRate because it's really hard to get an honest answer to a simple question—what's a good rate for me right now, and where can I get it? Even big mortgage companies struggle to figure out whether their interest rates are better or worse than another lender on any given day. But not having a clear and simple answer to “what's a good rate for me” costs homebuyers in the U.S. a lot of money—roughly $11 billion in 2025 alone.

We created TrueRate to make it easier for people to find lenders with low interest rates for their specific situation. Tomo Mortgage has lower rates a lot of the time, but we're not always the best pick for everyone 100% of the time. No lender is. But, when people have more information they can make better decisions, save money, and everyone wins.

TrueRate uses a mix of public and private data to estimate what rates lenders are actually offering to people like you. Rather than other websites that use lenders' advertised interest rates, we use real loan data (about a million loans, and we're adding tens of thousands every day). It focuses on one of the most common types of mortgage: 30-year, fixed-rate conventional loans for primary residences.

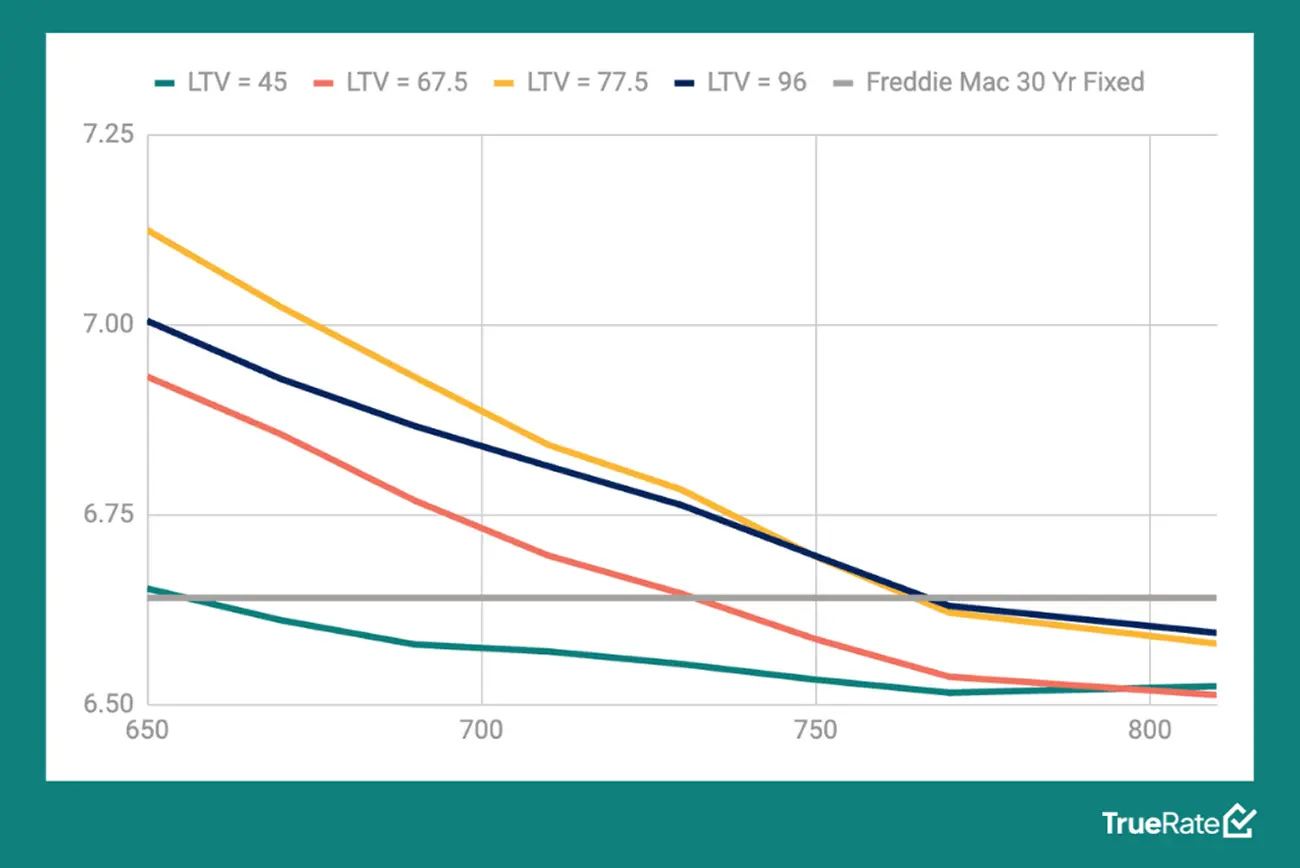

To answer this accurately, we take into account:

- Your credit score

- Your home price and down payment (so that we know the loan-to-value ratio)

- Your location (city and state)

- Discount points (we normalize our data to account for “par rate,” that is, a rate with zero added point fees and very close to the APR)

With all this data, we're able to see what other lenders are charging people in the same situation. We break down these rates into three categories:

- Good rate = better than 70% of lenders (top 30th percentile)

- Average rate = middle-of-the-road (50th percentile)

- Bad rate = higher than most people pay (bottom 70th percentile)

This way, you can see how your quote stacks up against the market.

Unlike other mortgage comparison tools, TrueRate doesn't use advertised rates provided by a small subset of lenders. Instead, TrueRate is a model that factors a wide range of lenders—over one thousand of them across the U.S. This includes big, independent mortgage companies, major banks, and small nonprofit credit unions. The model is trained on real loan data, pulled from both public records (like government mortgage databases) and private and proprietary sources (special datasets that include pricing and borrower traits).

We've tested and validated our model in two key ways.

- Benchmark tracking. Does our model yield similar results to 3rd party benchmarks?

- Control effectiveness. When we say we're controlling for variables in the loan scenario, does the model sufficiently capture the nuances of how each variable impacts market rate?

Here's how our model performed.

No, not exactly. TrueRate is designed to show you what's typical based on recent trends. Because we don't work directly with any specific lender (apart from ourselves), we can't promise a lender will give you that exact rate shown on the platform.

Think of TrueRate like a really smart compass—it shows you the direction and gives you a solid baseline to compare against, even though individual lender offers may still vary a bit. More important, the more data you have going into a conversation with a lender, the more confident you can be when negotiating an interest rate.

Here's what you get when you use TrueRate:

- A clear, customized look at the rate you should expect

- Confidence when comparing lenders or negotiating an offer

- A fair, apples-to-apples way to shop for a mortgage

- Zero gimmicks—just data-backed results

TrueRate won't magically get you the lowest rate on Earth. But it will tell you, honestly, whether the rate you're being offered is fair—and that's one of the smartest moves you can make when buying a home.

Texas is a great place for home buyers

Thinking about buying a home in Texas? You might be in luck. Mortgage interest rates here are currently lower than in many other states, which could make owning a home—maybe even that spacious Texas dream house—much more affordable.

Over the past five years, interest rates in Texas have seen some dramatic changes. In 2019, rates were relatively stable, averaging around 4% for a 30-year fixed mortgage. It was a solid time to buy or refinance.

Then came 2020 and the pandemic. In response to the economic uncertainty, the Federal Reserve lowered interest rates to historic lows. By mid-2020 and into 2021, mortgage rates in Texas dropped to around 2.5% to 3%. Homebuyers jumped at the opportunity—refinancing and purchasing surged while borrowing costs were unusually low.

By late 2021 and into 2022, however, rates began to rise again. The Fed, aiming to slow inflation, increased interest rates. By 2022, Texas mortgage rates climbed to around 5% to 6%, and in 2023, some even reached 7%, depending on the lender and your credit profile.

Even with these increases, Texas still compares favorably to many other states. Home prices remain relatively affordable, especially when you factor in the state’s lower cost of living and the lack of a state income tax. Those benefits help offset some of the pressure from higher borrowing costs.

All in all, Texas has remained a strong option for homebuyers over the past several years. With improving interest rates and the state’s overall affordability, now could be a great time to start looking for a home in the Lone Star State.